option,future &risk management

金融风险作业代写 I borrow $163,488 from the market and buy 330,279 shares of put option to create initial delta-neutral portfolio.

1.Background Information and Objective

An investor holds the $1 million stock position of Sydney Airport and recently the stock price flucuates a lot. The investor wonder how to effectively hedge the fluctuations of positions. In this paper, I first analyze the historical stock price, its one-year historical volatility, the one-year implied volatility (IV) of at the money(ATM) call and put. Then, I examine two kinds of delta-neutral hedging strategy following calendar-rebalancing discipline. Lastly, I evaluate the effectiveness of each delta-neutral hedging strategy.

2.Sydney Airport Stock Data

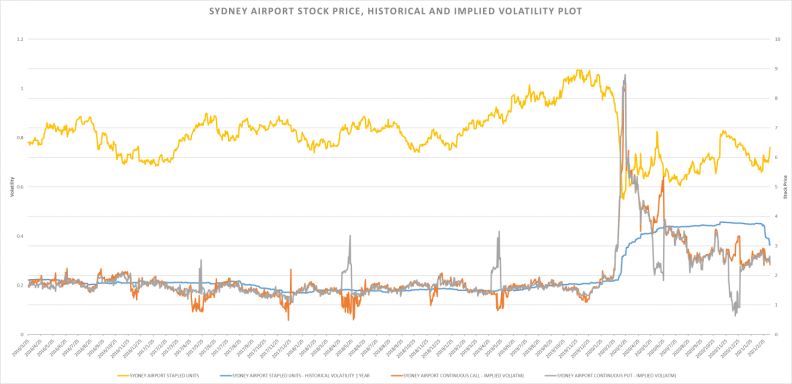

The plot above contains the line of Sydney Airport historical stock price, one-year histocial volatility and IV of ATM call and put. Note that historical volatility is an estimate of realized volatility, and the implied volatility is the volatility that, when used in conjunction with the Black-Scholes-Merton option pricing formula, gives the option market price. The left y-axis represents volatility and the right y-axis represents stock price. There are some interesting observations and my point of views are show as follow: 金融风险作业代写

(1) According to the put-call parity, the IV of ATM call and put with same underlying, strike price and time to execute should be the same theoretically. However, the plot shows that, most of time, the IV of ATM call and put are not same due to the market friction. The IV lines of ATM call and put continually separate and then intersect because of the exists and elimination of risk-free arbitrage opportunities.

(2) Most of the time, the implied volatility of ATM put are higher than that of ATM call with same terms. In my opinion, this is because it’s easy to cause panic when the stock price decline and thus enlarge the implied volatility.

(3) The IV exhibits a mean-reversion property and is a “leading indicator” because it changes earlier than historical volatility and price movement. The IV is relatively lower compared with mean-reversion level, which creates an volatility arbitrage opportunity.

(4) When the stock price crashed, both IV of ATM call and put increased sharply. In my option, this is because the market’s uncertainty about the direction of stock movement and expects the stock continual fluctuations.

3.Delate-Neutral Heding Strategy 金融风险作业代写

From the analysis above, I decide to use a dynamic hedging strategy to maintain a delta-neutral position by using underlying and options. A delta-neutral position means that a portfolio has no sensitivity to small changes in the price of the stock price of Sydney Airport. The idea is:

The delta of underlying position + The delta of option position = 0

There are two kinds of hedging strategy I can take:

(1) Hold underlying and buy put options;

(2) Hold underlying and sell call options;

Normally there are two rebalancing strategies:

(1) Calendar-based Rebalancing: for example, rebalance the portfolio every 2 trading days;

(2) Percentage-of-Portfolio Rebalancing: for example, rebalance the portfolio when the total positions fluctuate more than 10% of original position.

Since our goal is to effectively hedge the position, I decide to use calendar-based rebalancing strategy and reblance the portfolio ever trading day.

Assumptions:

1) there are no commision fees;

2) the holding period is , thus the interest cost is small enough to ignore;

3) one share of option’s underlying is one share of stock;

3.1 Holding the underlying and buy Put option 金融风险作业代写

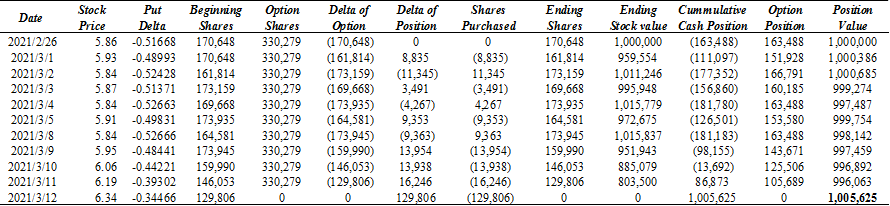

The initial shares: 1,000,000/5.86 = 170,648 shares of Sydney Airport stock.

The number of put option needed:

170,648 + (-0.51668 * number of put option) = 0

Number of put option = 330,279

I borrow $163,488 from the market and buy 330,279 shares of put option to create initial delta-neutral portfolio. Then, I continually rebalance the portfolio by adjusting the stock position to make sure the delta of total portfolio is 0 at the end of each trading day. For example, the put delta change from -0.51668 to -0.48993 and the delta of my portfolio changes to 8,835. (170,648 – 0.48993 * 330,279) Thus, I need to sell 8,835 shares of stock to keep delta-neutral. The details are

presented as follow:

Last day, I sell all the stock positions and sell the put options to close all my position. The ending value is $1,005,625. 金融风险作业代写

3.2 Hold Underlying and Sell Call Options

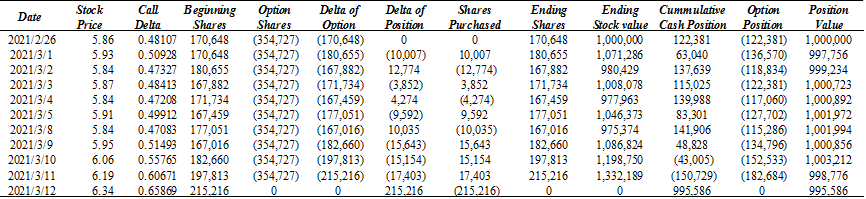

The initial shares: 1,000,000/5.86 = 170,648 shares of Sydney Airport stock.

The number of call option needed:

170,648 + (0.48107 * number of call option) = 0

Number of call option = -345,729

I write 354,727 shares of call options and to create initial delta-neutral portfolio. Then, I continually rebalance the portfolio by adjusting the stock position to make sure the delta of total portfolio is 0 at the end of each trading day. For example, on 2021/3/1, the call delta change from 0.48107 to 0.50928 and the delta of my portfolio changes to -10,007 (170,648 – 0.50928 * 354,727) Thus, I need to buy 10,007 shares of stock to keep delta-neutral. The details are presented

as follow:

Last day, I sell all the stock positions and buy the same call options to close all my position. The ending value is $995,586.

4.The Effectiveness of Hedging Strategy

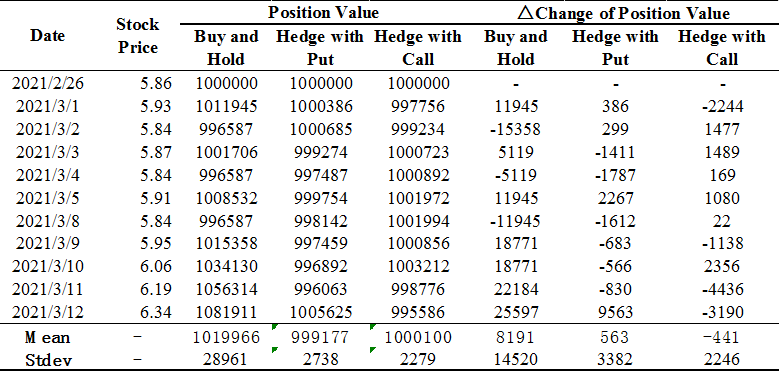

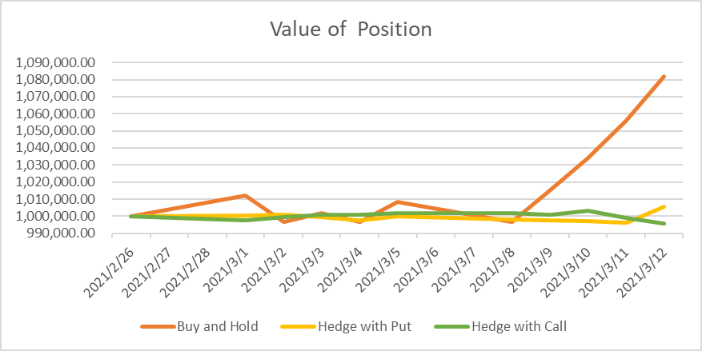

Lastly, I evaluate the effectiveness of delta hedging by examine the position value and change value of position. From the chart and graph above, we can conclude that:

1) Both hedging strategy works well compared with holding underlying only. 金融风险作业代写

2) Hedging with call works a little bit better than that of put, because the standard deviation is smaller.

发表回复

要发表评论,您必须先登录。