Coursework 2 Assignment Brief, Assignment Guidelines and Rubric

金融管理作业代写 Analyse the Investment proposals by using NPV and IRR and provide recommendations. You should also briefly comment on other

Details of the task 金融管理作业代写

CASE STUDY 1 – Solution to Food Wastage

“Upcycling promises to turn food waste into your next meal …

Globally, more than one-third of all current food production will be lost or wasted somewhere between the farm or ranch and the consumer’s garbage can. Food ‘losses’ may be due to improper handling or storage conditions on the farm or in the food distribution process, whereas food ‘waste’ often results from limited shelf life or consumers not making use of perishable products before they spoil in the fridge.

From an economics standpoint, finding market outlets for otherwise wasted products makes sense, and the food industry recognises that fact.”

– The Conversation, June 22, 2021 金融管理作业代写

GrubHeven Corporation is a listed food processing company that specialises in the manufacturing of various food products, and markets many well-known brands. The company is committed to sustainability and a better future for coming generations. The company learned that hundreds of millions of pounds of agricultural produce stayed in fields to rot because the produce was too unattractive for supermarket sale.

GrubHeven decided to create a product that could help avoid that waste. The company is appraising the feasibility of investing in a new production line that converts fruits into flour, which can be added to drinks, baked goods and other products. This also helps increase incomes of farmers. The following information involves required investment, projected revenues and expenses, and other information for this project.

a Core machinery assets and production facilities would have to be acquired and installed. These assets are 金融管理作业代写estimated to cost $120 million, including installation cost. These would have to be fully paid before commencement of production.

b. The proposed production facility will need to re-claim an entire lower floor of the factory building, which is currently being leased out to a dairy product processor, at a monthly rental of $200 000.

c The newly acquired assets are expected to have a 10-years useful life, till the next technological disruption. There is no scrap value at the end of asset’s life. Depreciation on the new assets will be at cost over 10 years using straight line method.

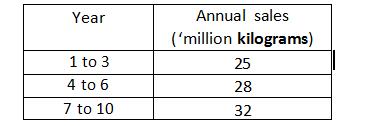

d Annual sales in pounds over the next 8 years are projected to be as follows:

e,Production would require increase of working capital of $4 million to finance operations such as inventory purchases. Current liabilities will also be expected to increase by $1.5 million. This net working capital will be released at the end of the asset’s life.

f Each kilogram of flour would sell for $2.

g Monthly fixed expenses (excluding depreciation) is projected at $1.5 million. Included in fixed expenses are administration, sales and marketing expenses. Variable costs of production would be $0.20 per kilogram.

h GrubHeven’s board of directors has specified a required rate of return of 12% on this investment.

I GrubHeven pays a corporate tax rate of 18%. Capital gain on asset disposal is charged at corporate tax rate.

Case Study 2 – Budgeting Ahead 金融管理作业代写

On Jan 1, 2021, GrubHeven is attempting to budget cash flows through Mar 31, 2021. On this latter date, an unsecured note will be payable in the amount of $4 million, at 3% per annum. This amount was borrowed on Sep 30, 2020 to carry the company through the seasonal peak in Oct through Dec 2020. Cash Interest payment are settled monthly.

The company only transact on credit sales. A discount of 5% is given to all customers who pay within one month. 30% of the accounts receivable will be received in the month of sale. 50% will be collected in the following month, and 20% will be received 2 months after sale. There is a 5% provision for bad debt for accounts receivable owing 2 months after sale.

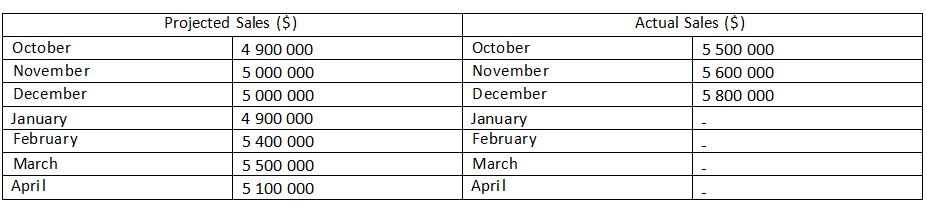

Projected and Actual Sales are:

Purchases are made on basis of 60% of the following month’s projected sales. Half of the purchases are paid for in the month of purchase, and a 5% prompt settlement discount is received. The remainder is paid in full the following month.

Total budgeted fixed operating expenses for the year are $12 million. Fixed costs are accrued evenly through the year. The operating variable costs is determined to be 15% of that month’s projected sales. Both fixed and variable operating expenses are paid in the month incurred.

Opening cash balance as at 1 Jan 2021 is $4 500 000.

Requirements: 金融管理作业代写

You will be required to write a management report in which the following points should be discussed.

• Analyse the Investment proposals by using NPV and IRR and provide recommendations. You should also briefly comment on other investment proposal techniques that GrubHeven may use, and the limitations of using these techniques.

• Provide an explanation on the different sources of funding available to the company, and their advantages and disadvantages and make recommendations as to how these funding sources are appropriate to the planned investment project.

• Analyse the level of breakeven required should GrubHeven proceeds with the investment.

• Prepare a forecasted cash budget for January to March 2020.

• An evaluation of GrubHeven’s performance or position during the same period. 金融管理作业代写

• A detailed Literature Review of the tools you have used such as capital investment techniques, breakeven analysis and budgets and their importance to the business case.

• Other issues for management to consider that you think are vital for them to survive and make a profit.

Assignment Guidelines

Structure

You have been asked to produce an individual report (word count 2,500). It should contain the following:

• Appropriate coversheet (as attached in this document)

• Title Sheet

• Executive Summary

• Contents Page

• Introduction

• Literature review to support your accounting models used.

• Sources of Funding

• Investment appraisal

• Cash budgeting 金融管理作业代写

• Breakeven analysis

• Evaluation

• Any other issues to be considered.

• Conclusions and Recommendations

• Appendices which should be numbered. (Make sure you refer your reader to them as required)

Layout

Your work should be word processed in accordance with the following:

• Font style, Arial, font size 12

• 1.5 line spacing.

• The page orientation should be ‘portrait’

• Margins on both sides of the page should be no less than 2.5 cm

• Pages should be numbered

• Your name should not appear on the script.

.

PLAGIARISM WARNING! —Assignments should not be copied in part or in whole from any other source, except for any marked up quotations, that clearly distinguish what has been quoted from your own work. All references used must be given, and the specific page number used should also be given for any direct quotations, which should be in inverted commas. Students found copying from the Internet or other sources will get zero marks and may be excluded from the university. Word Count –Any work submitted with more than 2500 words will be have 10 marks deducted.

Marking Criteria/Rubric

更多代写:cs代写 经济代考 会计代写 计算机科学代写 Turnitin查重率

发表回复

要发表评论,您必须先登录。