Asset Economy Exercises

经济练习作业代写 Exercise 3.4 from Lengwiler. Consider a two-period economy with Öve possible states in the future. There are no markets for Arrow

- Exercise 3.2 from Lengwiler. Suppose there are two states and three Önancial assets, a risk-free bond with state-contingent cash áows (100; 100), a risky bond that pays only in state 2, with cash áow (0; 100), and a share with cash áow (20; 35). Can you Önd a portfolio containing only shares and risky bonds that reproduces 40 risk-free bonds?

- Exercise 3.3 from Lengwiler. Consider a situation in which there are Öve states, and suppose you can observe the prices of the Arrow securities. They are (0:1225; 0:2451; 0:3676; 0:0613; 0:1838).

(a) Compute the price of a risk-free bond and the risk-free rate of return. 经济练习作业代写

(b) What are the risk-neutral probabilities of the Öve states?

(c) How much does a hypothetical asset cost with cash áow (5; 5; 2; 7; 4)?

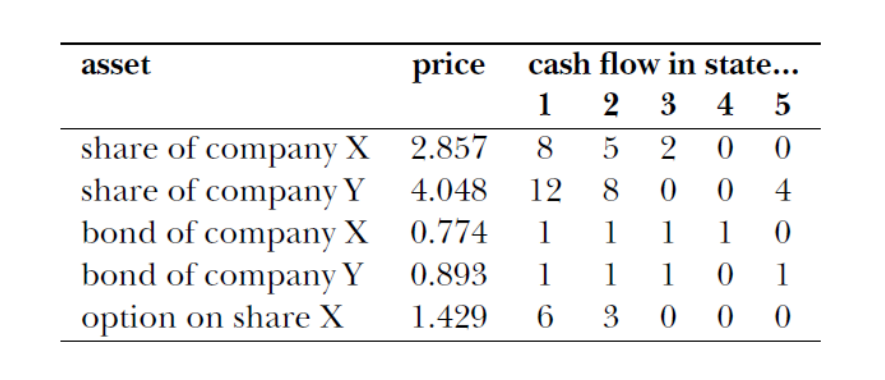

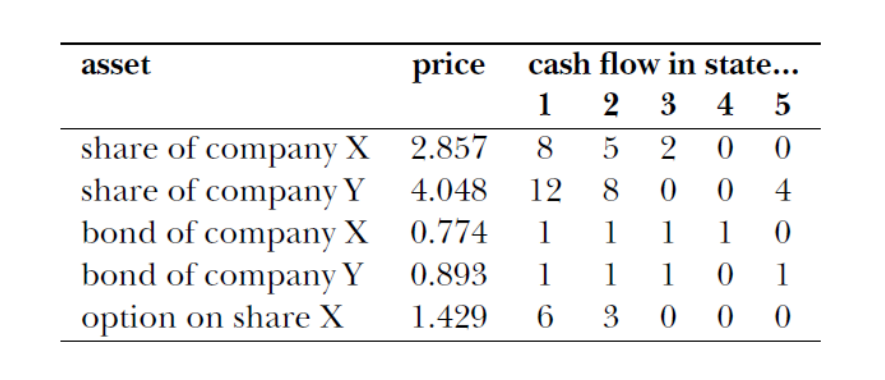

- Exercise 3.4 from Lengwiler. Consider a two-period economy with Öve possible states in the future. There are no markets for Arrow securities, so you can not observe the Arrow security prices. Yet, you can observe the prices of the following Önancial assets:

The option on the share of company X is a call option with exercise price 2.

(a) Is the market complete?

(b) Compute the prices that Arrow securities would have if they were traded.

(c) Are there arbitrage opportunities in this market? Prove your claim.

(d) Compute the risk-free rate of return.

(e) Compute the risk-neutral probabilities.

(f) Consider a call option on a share of company Y with exercise price 5.

What state-dependent cash áow does this option have? How much should it cost?

- Consider an economy with one good and two states.

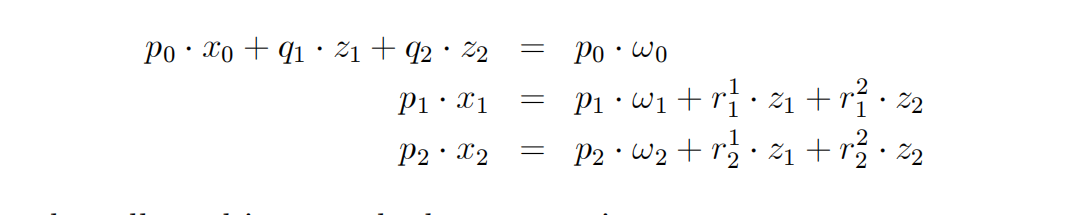

- a) Suppose we have two Önancial assets and the asset markets are complete.

Show that a consumerís budget constraints for s = 0; 1; 2,

can be collapsed into one budget constraint

Q1 x1 + Q2 x2 + x0 = Q1 !1 + Q2 !2 + !0

Determine Q1 and Q2: (you may use some particular values for r11 ; etc.)

(b) Interpret the budget constraint in a: through Arrow security prices.

(c) Suppose we have one Önancial asset hence the asset markets are not com plete. Show that a consumerís budget constraints for s = 0; 1; 2,

p0 x0 + q1 z1 = p0 !0

p1 x1 = p1 !1 + r1 z1

p2 x2 = p2 !2 + r2 z1

can be collapsed into two budget constraint 经济练习作业代写

P1 x1 + x0 = P1 !1 + !0

P2 x2 + x0 = P2 !2 + !0

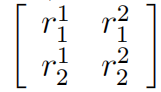

- Suppose we have 2 Önancial assets and the asset markets are complete. Formu late the portfolio choice problem. That is consider the agent with today wealth w0;who has access to the Önancial markets with two assets with the payo§s

with the prices of the assets (q1; q2): (you may use some particular values forr11; etc.) At date 0 the agent can decide on asset holdings(z1; z2)which determines his t = 1 wealth, call those w1 and w2 in the corresponding states.(a) Derive the agentís budget constraint, that is the combinations of w1 and w2 that are feasible given the markets and the initial wealth.(b) Connect the no arbitrage condition to the slope of the budget constraint.

with the prices of the assets (q1; q2): (you may use some particular values forr11; etc.) At date 0 the agent can decide on asset holdings(z1; z2)which determines his t = 1 wealth, call those w1 and w2 in the corresponding states.(a) Derive the agentís budget constraint, that is the combinations of w1 and w2 that are feasible given the markets and the initial wealth.(b) Connect the no arbitrage condition to the slope of the budget constraint.

发表回复

要发表评论,您必须先登录。