FINM7409 Financial Management for Decision Makers

决策者财务管理作业代写 By comparing the trend of the profitiability of these two companies over the 5-year period, we can see that Woolworths

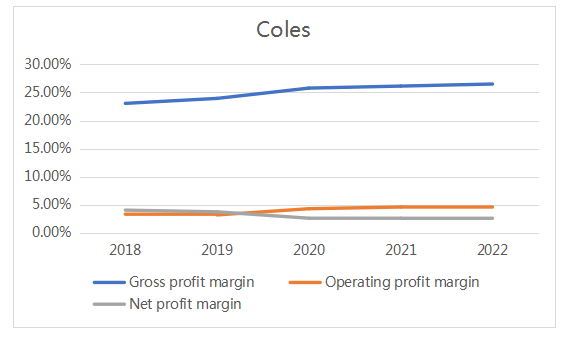

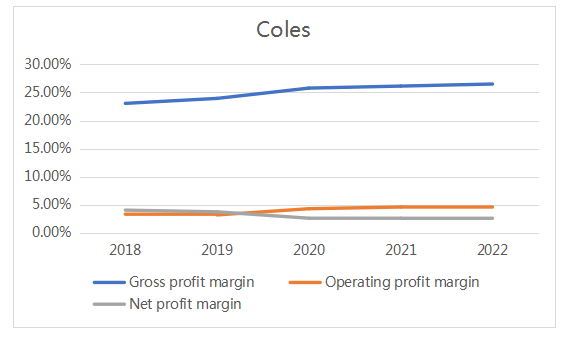

As can been seen from table 1, both the gross profit margin and operating profit margin of Coles Group Limited (“Coles”) slightly increased from 2018 to 2022, whereas the net profit margin slightly decreased over the same period. The key drivers of such trend could be due to:

- The decrease in cost of goods sold from 2020, which in turn increased the gross profit margin. 决策者财务管理作业代写

- The decrease in Selling General & Admin Exp. from 2020 lead to the decrease in operating profit margin.

- No earnings from discontinued operations since 2020, which resulted in decrease in net profit margin.

Table 1: Gross profit margin, operating profit margin and net profit margin of Coles for 2018 to 2022

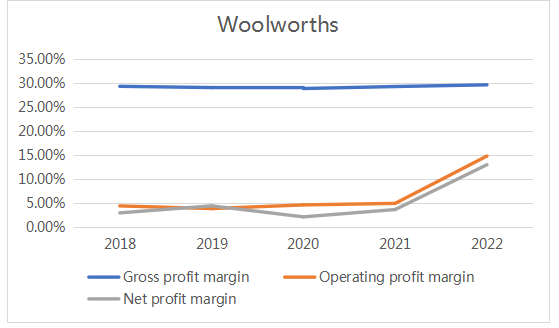

As for Woolworths Group Limited (“Woolworths”), Table 2 shows that the gross profit margin had been stable over these 5 years period. However, both the operating profit margin and net profit margin started to increase significantly from 2021 to 2022. 决策者财务管理作业代写

The increase in operating profit margin in 2022 was mainly attributable to the decrease in Selling General & Admin Exp, whereas the increase in net profit margin was due to the earnings from discontinued operations.

Table 2: Gross profit margin, operating profit margin and net profit margin of Woolworths for 2018 to 2022

By comparing the trend of the profitiability of these two companies over the 5-year period, we can see that Woolworths outperformed Coles on gross profit margin and operating profit margin. Although net profit margin of Woolworths had been very close to that of Coles for 2018 to 2021. It was much higher than that of Coles in 2020 due to earnings from discontinued operations. The most important factors underlying the difference in financial performance of these two companies are: 决策者财务管理作业代写

- If the management can efficiently control its costs and expenses. It can improve the profitability of the company. For example, Woolworths reduced great porportion of its selling and adminsitrative expenses in 2022, which in turn increased the operating profit margin. Also, the improvement in profitability of Coles was also due to the efficient control of operating expenses.

If the company is able to charge the customers a higher percentage over the costs. It will have more gross profit left over to cover its expenes. For example, the gross profit margin of Woolworths had been higher than that of Coles over the 5-year period, one of the reasons that caused the higher operating profit margin in Woolworths as well.

Although Coles recorded increasing trend in terms of its gross profit margin and operating profit margin.

Its net profit margin had been decreasing and they had remained at low level of percentage. In future years, if the company will not be able to control its expenses, the increase in gross profit margin will be insufficient to cover its operating expenses and other expenses. There will be possibility that Coles may turn from net profit to net loss in 2-5 years’ time.

Although Woolworths recorded much higher net profit margin in 2022. It was due to the earnings from discontinued operations. This indicated that it was non-recurring source of income which would not appear in next periods. The operating profit margin and net profit margin are likely to return to what they were from 2018 to 2021. 决策者财务管理作业代写

The major chanllange faced by Woolworths is how to maintain the high gross profit margin and the competitive advantages at the same time. Also, Woolworths should consider how to maintain low level of selling and administative expenses as they did in 2022. If the selling and administrative expenses are too low. It may affect the sales revenue negatively. If they are too high, the operating profit margin and net profit margin will decrease. This is the dilema faced by Woolworths.

发表回复

要发表评论,您必须先登录。