Expected Utility in Asset Economy Exercises

经济学midterm代考 where xs, with s = 1; 2, denotes state-contingent consumption, then they will insure each other completely, irrespective of their

1. Problem 5.1 from Lengwiler. 经济学midterm代考

- For an economy with two agents, one good and two states without the aggregate uncertainty, show the following. Support your argument with a diagram.

(a) If both agents have preferences that satisfy the expected-utility hypothesis, and if the players hold identical beliefs about the probability of the two states, then the equilibrium prices will be proportional to the probabilities of the two states.

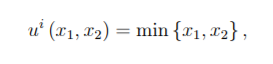

(b) If agents have utility functions of the type

where xs, with s = 1; 2, denotes state-contingent consumption, then they will insure each other completely, irrespective of their beliefs about the probabilities of the states. 经济学midterm代考

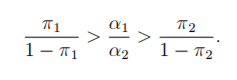

(c) If the players have von Neumann-Morgenstern utility functions but player i believes that state 1 occurs with probability i , with 1 > 2; then the equilibrium price ratio 1=2 will satisfy

- Problem 5.3 from Lengwiler.

- Problem 5.4 from Lengwiler.

Part 2 (week 2 of the topic) 经济学midterm代考

- Problem 5.2 from Lengwiler.

- Problem 5.5 from Lengwiler.

- Problem 5.6 from Lengwiler.

- Problem 5.7 from Lengwiler

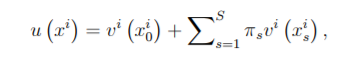

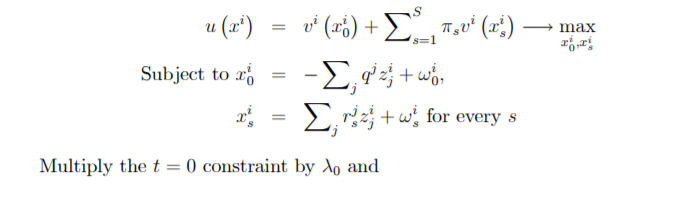

Suppose

;where vi is an increasing concave function. Suppose that the Önancial markets are complete (so there is a complete payo§ matrix r of appropriate dimension) and that Örst security is a riskless bond: r1 = (1; :::; 1): Let ws be the aggregate endowment in state s.

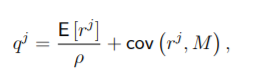

(a) Show that the equilibrium price of security j can be writ 经济学midterm代考

;recall that Ms = s=s for every s and is the risk-free (gross) interest rate.

(b) How do we deÖne the risk-premium on security j? Explain the economics in terms of the nature of the stochastic dependence between the aggregate endowment ws and rj. For what kind of security do you expect the sign of the premium to be positive? Why?

Solution. Each agent sol 经济学midterm代考

发表回复

要发表评论,您必须先登录。