EXAMINATION PAPER

Faculty of Business and Law

法律学EXAM代写 Burt Ltd enters into a six-year lease agreement with Ernie Ltd on 1 July 2021 to acquire machinery. The machinery is expected

Anticipated writing time: TWO (2) HOURS 法律学EXAM代写

Maximum exam time: You must submit your exam response within THREE (3) hours. The additional hour includes reading time, time to download and save the exam paper and time to upload the completed paper into CLOUD.

Special instructions for candidates:

• This examination is OPEN BOOK.

• Calculators are ALLOWED.

• This examination constitutes 60% of your assessment in this unit.

• This examination comprises EIGHT (8) questions. You are required to answer ALL 8 questions.

• Save this document on your computer using the file name: student ID, unit code and the unit name, for example: 216123123 _Accounting

• Record all answers in the spaces provided below for each question

• Upload your exam response to the Exam Submission Dropbox in the Cloud unit site. Check that you upload the correct file.

• Late submissions will not be marked.

• Remember to save your work regularly. 法律学EXAM代写

It is important that you complete this task individually. Your submission will be reviewed for the purposes of detecting collusion and/or plagiarism.

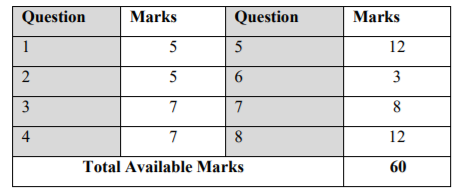

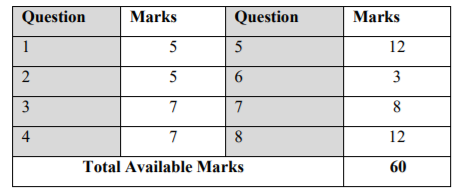

• The breakdown of marks in this exam is:

All candidates MUST complete this section

Type your student ID number here:

QUESTION ONE (5 marks) 法律学EXAM代写

As at 31 July, Garden Hardware Pty Ltd had Accounts Receivable of $52,000Dr and Allowance for Doubtful Debts of $1,000 Cr. During August Garden Hardware Pty Ltd recorded:

1) Sales of $180,000 ($160,000 credit and $20,000 cash)

2) Collections on account, $130,000

3) Write-offs of bad debts $2,400

4) Bad debt expense, estimated as 2% of Accounts receivable (using the balance sheet approach).

Required:

Journalise sales, collections, bad debt write-off and bad debts expense, using the allowance method for the month of August (Ignore GST, Narrations are not required)

QUESTION TWO (5 marks)

The following data at 30 June 2020 is given for Burwood Systems Pty Ltd.

- Depreciation, $500

- Four months of rent, $2,400 were paid in advance on 1 June.

- The company has a cash investment of $90,000 for 4% p.a. with ABC Bank. The interest is paid annually at the end of calendar year. The interest revenue is accounted on a monthly bases by the company.

- Employee salaries owed for Monday to Thursday of a five-day working week; weekly payroll, $13,000

- Unearned service revenue earned, $1,300 法律学EXAM代写

Required:

Journalise the adjusting entries needed on 30 June 2020.

QUESTION THREE (7 marks)

Moon Medical Laboratory is a medical research company which believes it has discovered a drug that will cure for cancer. The company is protecting the drug’s formula by keeping it secure in the company safe and is currently in talks with interested companies to produce the drug for sale. Being the first of its kind and therefore unique, the company has no idea as to the formula’s value. Outline how Moon Medical Laboratory should account for the formula, justifying your answer by reference to relevant definitions and recognition criteria outlined in the Conceptual Framework.

ANSWER HERE

QUESTION FOUR (7 marks) 法律学EXAM代写

Explain whether you would recognise the item below as an asset, justifying your answer by reference to the Conceptual Framework’s asset definition and recognition criteria: Discovery (at insignificant cost) of evidence of mineral reserves (additional information:There is a market for this mineral and the company has rights over the site).

ANSWER HERE

QUESTION FIVE (12 marks)

a) Using the perpetual inventory system, prepare general journal entries for the following transactions of Smart Office Pty Ltd. GST must be accounted for.

June 2016

3 Purchased $17,820 (GST inclusive) of inventory on credit

7 Returned $1,320 (GST inclusive) of damaged goods purchased on 3 June

9 Sold inventory on credit for $28,050 (GST inclusive). These goods cost the business $12,750

11 Customer returned defective inventory from the 9 June sale, $1,980 (GST inclusive). The cost of inventory was $900

15 Received payment from customer (less 2% settlement discount) for the credit sale on 9 June

20 Paid supplier in full for the purchases of 3 June less 1% discount. 法律学EXAM代写

QUESTION SIX (4 marks)

Identify and briefly explain any two (2) financial statement assumptions.

ANSWER HERE

QUESTION SEVEN (8 marks)

Curtain Plus Ltd commenced business on 1 July 2020. On 1 September 2020, it purchased a cutting machine for 38,500 (GST inclusive), with two equal instalments payable on 1 October and 1 November 2020. Transportation costs of $1,320 (GST inclusive) were paid in cash to deliver the machine to Curtain Plus Ltd’s premises. The machine was expected to have a useful life of 5 years and a residual value of $3,000 (excluding GST).

Required: 法律学EXAM代写

Prepare general journal entries (narrations are not required) to record the transactions and to record depreciation (Straight-line method) adjustments necessary for the year ended 30 June 2021 (round all amounts to the nearest dollar). You must account for GST

QUESTION EIGHT (12 marks)

Burt Ltd enters into a six-year lease agreement with Ernie Ltd on 1 July 2021 to acquire machinery. The machinery is expected to have an economic life of ten years, after which time it will have an expected residual value of $10,000. The agreement includes a bargain purchase option that Burt Ltd will be able to exercise at the end of the sixth year of $60,000. The agreement requires six annual payments of $90,000, the first being made on 30 June 2022. Included within the $90,000 lease payments is an amount of $10,000 representing payment to the lessor for the insurance and maintenance of the machinery. The machinery is to be depreciated on a straight-line basis.

Additional information: 法律学EXAM代写

• The agreement has an implicit interest rate of 6 per cent

• Present value of an annuity in arrears of $1 for six years at 6 per cent = 4.917

• Present value of $1 in five years at 6 per cent = 0.705

Required:

i) Calculate the present value of lease liability. (3 marks)

ANSWER HERE

ii) Prepare all the journal entries in the records of Burt Ltd for the financial year ended 30 June 2022 and 30 June 2023. [Note: Rounded to nearest integer and narrations are not required]. (9 marks)

发表回复

要发表评论,您必须先登录。