Harvey Norman Financial report

会计硕士论文代写 They also offer a range of services, including installation, repair, and financing options. In addition to its retail operations

Executive Summary 会计硕士论文代写

Harvey Norman is a large Australian retail company that specializes in furniture, bedding, computers, electronics, and home appliances. Harvey Norman's overall strategy is focused on a strong balance sheet, with care to employees, and delivers its wide-range product offering through its “own your flagship” strategy.

The company's financing history reveals that the increase in long-term debt was not a result of financing activities but an accounting system adjustment. From 2018 to 2021, the company’s long-term debt, excluding capitalized leases, had been decreasing. But in 2022 it started borrowing again. The company's dividend policy is to payout dividends in a way that the payout would not impact the overall strategic goals of the company, and the company tended to deliver most of its earnings per share out as dividends. 会计硕士论文代写

Utilizing CAPM and WACC methods, the company’s cost of equity is estimated to be 7.67%, and its cost of capital is estimated to be 7.43%, based on 2022 data.

Company Brief

Harvey Norman, funded in 1961 by Gerry Harvey and Ian Norman, is a large Australian retail company that specializes in furniture, bedding, computers, electronics, and home appliances. The company's retail offerings include furniture, bedding, electrical and small appliances, computers and communication products, home entertainment, flooring, and accessories.

They also offer a range of services, including installation, repair, and financing options. In addition to its retail operations, Harvey Norman is also involved in property investment and franchising. The company has a strong presence in the Australian and New Zealand markets and is a well-known household name in both countries. And today it has over 280 stores in Australia, New Zealand, Europe, and Southeast Asia.

Harvey Norman's overall strategy is focused on a strong balance sheet, with care to employees. And delivers its wide-range product offering through its “own your flagship” strategy.

Based on Lo, D.’s (2020) interview with the company’s CEO Katie Page 会计硕士论文代写

Katie discussed how the company invest in its employees which helped the success of its operation in Ireland. Also, the CEO talk about how a strong balance sheet helped the company survive and prosper after numerous natural disasters affecting its physical stores.

The CEO also talked about how the company practices the “own your flagship” strategy which means a hands-on management style on major retail outlets, with the stores designed by the designing team from both Harvey Norman and the brands being displayed in the store to come up with a store design (Lo, D., 2020).

Financing History

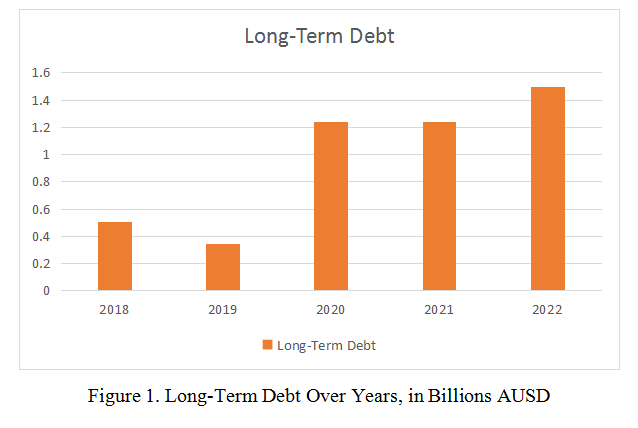

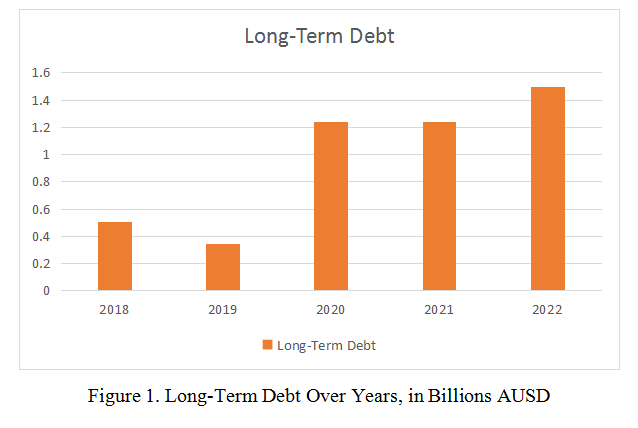

Looking at the financial report, over the past five years the company raised a huge amount of money from long-term debt, as shown in the graph below with data taken from Market Watch.com (2023).

While such a large increase in long-term debt with no signs of decline seems to be a huge challenge to the company and might indicate a large borrowing from banks or other lenders, a deep look into the financial report of 2020 (Harvey Norman, 2021) revealed that the increase of the long-term debt was caused by the company adopting the AASB 16 Leases starting from FY 2020.

And under the new accounting standard the company realized both a long-term lease liability under the long-term liabilities and a right of use assets under the asset section. Thus, the increase in debt was not a result of financing activities but accounting system adjustment. In fact, from 2018 to 2021, the company’s long-term debt excluding capitalized leases had been decreasing from 500 million to 200 million, which is in line with the company’s strong balance sheet strategy of limiting the debt-to-equity ratio.

However, this number increased again from 2021 to 2022. 会计硕士论文代写

And this time the increase was clearly due to an increase in a 238.52 million increase in long-term debt not relating to leases. Looking into the financial report of 2022, this increase was brought by a 2.1 million increase in syndicated facility agreements and a 0.28 million increase in other borrowings, indicating the company has utilized some of its available debt opportunities to bring in cash for the company in forms of interest-bearing long-term debt.

Other than debt financing, the company seems to have not utilized equity financing that much. However, between 2019 and 2020, the company’s ordinary shares increased by around 66 million shares. And the contributed equity from ordinary shares thus increased by 165 million. No other significant equity financing activities were detected from 2018 to 2022.

Overall, for the past five years, the company paid back a large portion of its long-term borrowings but then again borrowed a large sum in 2022 through debt financing and issued shares in 2019 to perform equity financing.

Dividend History and Policy

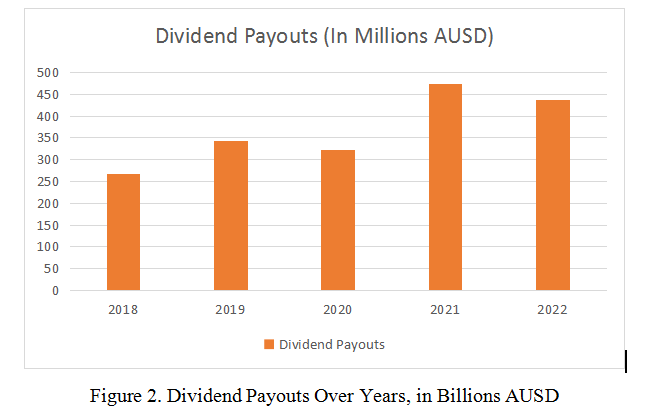

From 2018 to 2022, the company issued stable dividends and a huge portion of its cash was used for paying out these dividends, as shown in the graph below.

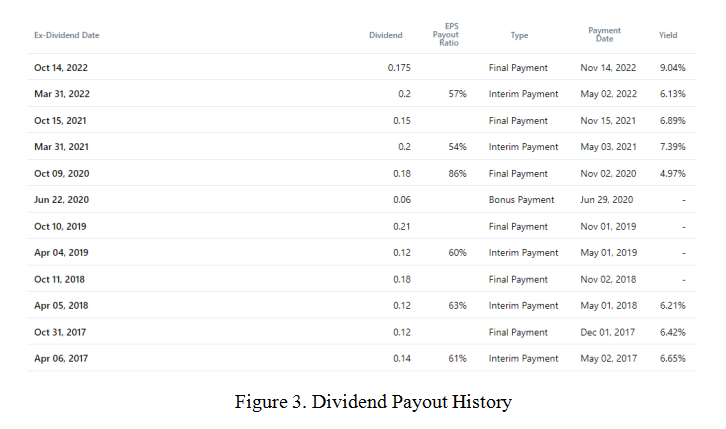

A detailed payment history can be found on Investing.com (2023), which tracks all dividend dates and amounts. The screenshot of the dividend per share data can be found below.

From the payment history only, it is clear that Harvey Norman followed a stable schedule for dividend payout, with an interim payment at the beginning of April and an annual final payment in mid-October. There had been one, and only one bonus payment in June 2020, which means this is not a usual case.

In general, the company tends to deliver most of its earnings per share out as dividends. 会计硕士论文代写

Usually around 60%, with 2020 being the exception and 86% of the earnings per share being delivered out as dividends. Generally, the dividend-to-share-price ratio is around 6%, which can be considered a high payout ratio. Together with the high payout ratio, the company tends to not keep the earning for the future but to give them back to shareholders as dividends.

Looking into the financial reports of 2020, the company’s directors clearly stated that their dividend policy is to payout dividends in a way that the payout would not impact the overall strategic goals of the company (Harvey Norman, 2021). 会计硕士论文代写

Thus, the payout was stable but the management did do some adjustments to ensure the long-term benefit of the company, such as the bonus payment in 2020 was distributed as a replacement for the regular interim payments which were canceled earlier that year to prepare extra cash facing the challenges brought by the COVID-19.

Thus, the dividend policy of the company should be concluded as a stable policy distributing more than half of the earnings out as dividends every year, while special consideration would be made facing operational challenges and uncertainties, such as the case of COVID-19 in 2020.

Capital Asset Pricing Model

Utilizing equity does not generate interest costs as how utilizing debt financing will, but using equity itself bears certain costs related to the opportunity costs of investing the capital elsewhere. Thus, to estimate the cost of capital utilized by the company, the Capital Asset Pricing model developed based on the security market line model as discussed in Chapter 12 of the Essentials of Corporate Finance (Trayler, R.S., et al 2022) would be used to assess the capital cost for Harvey Norman.

The formula for this model write as follows:

RE = Rf +BetaE * (RM-Rf)

In this formula, RE is the required return or the cost of equity, which represents the desired return under a certain risk level. The Rf represents the risk-free rate, which is usually estimated using a three-month government bill as its risk level is considered to be very low (CF1, 2022). The BetaE measures the volatility of the asset which represents its systematic risk relative to the average, and the RM represents the expected equity market return.

The (RM-Rf) combined is named the expected return of the market and based on historical data. 会计硕士论文代写

An estimation of 19% for the RM was proposed based on the work produced by David W. Mullins, Jr., (1982). However. another consideration is that this work is rather outdated and the recent stock market in Australia has only a 9.8% per annum return with data from 1992 (Hayden, M, 2022). Choosing the right RM is important in estimating the overall capital cost as this value would greatly impact the required return.

Considering the reality, when making investment options, consideration should be made based on more recent data as past performance can never directly be used to forecast the future. Thus, in this analysis, it is decided that the more recent 9.8% would be a more accurate estimation for the RM.

With all assumptions being made, certain values needed in this formula can be retrieved from various sources.

The risk-free rate would be the current 3-month government bill rate of Australia, and based on Investing.com (2023) the most recent rate is 2.45%. The 5-year monthly beta for Harvey Norman is 0.71 (Yahoo! Finance, 2023), meaning that the company has a relatively lower risk profile when compared with the average. Putting these numbers all together into the formula, the final cost of equity using the CAPM model is 2.45%+0.71*(9.8%-2.45%) = 7.67%.

Thus, by using the three-month treasury bill of Australia as a risk-free rate and the average Australian stock market returns for the past decades as the expected equity market return, combined with Harvey Norman’s relatively low beta of 0.71, the result of CAPM indicates that the cost of equity for Harvey Norman is 7.67%.

Weighted Average Cost of Capital 会计硕士论文代写

While the cost of equity is estimated using the CAPM model, the financing cost of the company includes not only the cost of capital but also the interest and other costs related to its debt. Combining the cost of equity as well as the cost of debts based on their relative weights would then form a weighted average of the company’s total cost of capital, which would show how much cost the company is currently bearing based on its financing structure. The formula of the weighted average cost of capital (WACC) can be found below.

WACC = (E/V)RE + (D/V)RD*(1-TC)

In this formula, E and D represent the amount of equity and debts, respectively. While V is the total value of equity and debt. Thus, the E/V and D/V measure the weights of equity and debt, respectively. RE represents the cost of equity which has been calculated using CAPM in the last section. And RD would have to be calculated using the company’s current interest rate on interest-bearing debts.

Also, interest payment can be used as an expense to be subtracted from the taxable profit which has a tax-saving effect, the cost of debt would thus have to exclude the tax-saving amount, and hence the (1- TC) represents the removal of the saved tax from the cost of debt.

Looking into the company’s 2022 financial report (Harvey Norman, 2023), total current and non-current interest-bearing loans, and borrowings are 700 million. And in 2021 the amount was 560 million. It is important to note that although the company bears a much larger long-term debt. 会计硕士论文代写

That portion of the debt was mainly formed by the long-term lease liabilities generating no interest.

As discussed in the second section of this report, and thus should not be considered in the WACC model as well. The interest expense in the year 2022 (Harvey Norman, 2023) is 52.15 million and dived by the average interest-bearing debt of average (700,560), the final cost of debt is 52.15/((700+560)/2) = 8.28%.

The tax rate can be calculated using the tax expense divided by the pre-tax income, which in 2022 (Harvey Norman, 2023) is (322.564/1140.443) = 28.28%.

The amount of equity can be found in 2022’s balance sheet (Harvey Norman, 2023) and the value is 4,294 million. Thus, the final WACC formula is:

WACC = (4294/(4294+700))7.67% + (700/(4294+700))8.28%*(1-28.28%) = 7.43%

Conclusion

This report reviewed the operation and strategy of Harvey Norman, an Australian retailer focusing on distributing home furniture and electric appliances. Recent financing including the debt changes and issuance of new shares were reviewed. The dividend policy of the company seems to be stable with more than half of the earnings being distributed. CAPM estimated the company’s cost of equity to be 7.67% and using the WACC method the company’s cost of capital is estimated to be 7.43%, based on 2022 data.

Reference 会计硕士论文代写

Corporate Finance Institute. (2022, December 5). Risk-free rate. Corporate Finance Institute. Retrieved February 26, 2023, from https://corporatefinanceinstitute.com/resources/valuation/risk-free-rate/

Harvey Norman Holdings. (2023). Reports & announcements. Harvey Norman Holdings. Retrieved February 26, 2023, from https://www.harveynormanholdings.com.au/pages/reports-announcements

Hayden , M. (2022, August 11). How have Australian shares performed in the last 30 years. Canstar. Retrieved February 26, 2023, from https://www.canstar.com.au/investor-hub/australian-share-performance-30-years/

Investing.com. (2023). Australia 3-month bond yield - Investing.com AU. Investing.com Australia. Retrieved February 26, 2023, from https://au.investing.com/rates-bonds/australia-3-month-bond-yield

Investing.com. (2023). Harvey Norman Holdings (HVN) dividend history. Investing.com India. Retrieved February 26, 2023, from https://in.investing.com/equities/harvey-norman-holdings-limited-historical-data-dividends

LO, D. A. W. N. (2020, March 23). Harvey Norman CEO on beating Australia's retail slump. UNSW Newsroom. Retrieved February 26, 2023, from https://newsroom.unsw.edu.au/news/business-law/harvey-norman-ceo-beating-australia%E2%80%99s-retail-slump

MarketWatch. (2023). HVN: Harvey Norman Holdings Ltd.. annual cash flow statement. MarketWatch. Retrieved February 26, 2023, from https://www.marketwatch.com/investing/stock/hvn/financials/cash-flow?countrycode=au 会计硕士论文代写

Mullins, D. W. (2014, August 1). Does the capital asset pricing model work? Harvard Business Review. Retrieved February 26, 2023, from https://hbr.org/1982/01/does-the-capital-asset-pricing-model-work

Ross, S. A., Westerfield, R., & Jordan, B. D. (2023). Essentials of corporate finance. McGraw Hill LLC.

Yahoo! Finance. (2023, February 26). Harvey Norman Holdings Limited (HVN.AX) valuation measures & financial statistics. Yahoo! Finance. Retrieved February 26, 2023, from https://finance.yahoo.com/quote/HVN.AX/key-statistics?p=HVN.AX

发表回复

要发表评论,您必须先登录。