APS 502 Computational Project Winter 2021

Matlab代写 For example, if the adjusted closing price of the last trading day in January 2018 for a stock was $60 and the adjusted closing price

Instructions: This is an individual assignment. For each optimization model below you need to (1) formulate the model by hand (typed is better) with all variables deÖned and the model objective and constraints fully written out and (2) print out the MATLAB Öle that contains the data (e.g. through the vectors/matrices) and call to linprog or quadprog used to compute the model in MATLAB and the output from calling linprog or quadprog that shows the optimal values for the variables and objective function values. Matlab代写

Do not just dump the MATLAB Öle, comment it and highlight the optimal values and highlight the important quantities like the optimal variance or optimal cost. You must use the MATLAB linprog and quadprog functions but you can call the function from python in which case you must print out your python code. Your project should be contained in a single pdf Öle (DO NOT MAKE THIS FILE TOO LARGE, must be less than 15MB) and when you send me the Öle via e-mail (rkwon@mie.utoronto.ca) MAKE THE SUBJECT OF YOUR EMAIL exactly as APS 502 Winter 2021 Computational Project . (I will not accept an e-mail that contains a link to your assignment, you must send me the assignment directly). Write your full legal name and student number on your assignment. Due April. 16 by 5PM (EST). Late assignments will incur penalty.

Problem 1 Part 1 Matlab代写

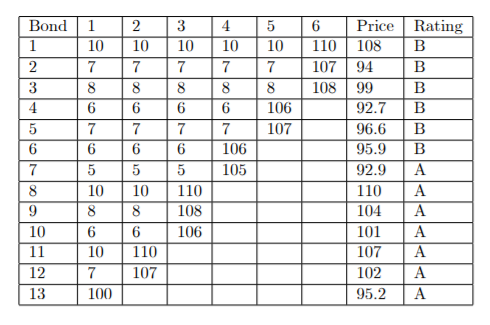

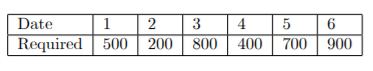

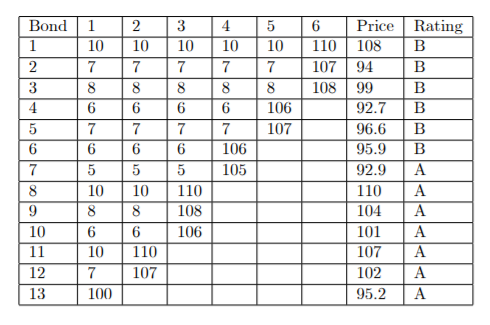

Formulate a linear programming model and solve using MATLAB to Önd the lowest-cost dedicated bond portfolio that covers the stream of liabilities given in the table below (allow cash to be carried forward at the forward rates that are consistent with the spot rates s1 = 1%; s2 = 1:5%; s3 = 2:0%; s4 = 2:5%; s5 = 3:0%; s6 = 3:5%):

with the set of bonds below:

Part 2 Matlab代写

Now consider a version of the problem where at most 50% of the bond portfolioís value (value is in dollars) can be in bonds rated B. Solve this model using MATLAB and compare with optimal bond portfolio from Part 1.

Part 3

Repeat Part 2 but with at most 25% of the bondís portfolio value in bonds rated B. Compare with the optimal portfolios from Part 1 and Part 2. Rank the 3 optimal portfolios according to the cost. Which is portfolio costs the least? Which portfolio costs the most?

Problem 2

PART 1 Matlab代写

You will use the following three ETFs (exchange-traded funds) to form a portfolio of these three assets. An ETF operates just like a stock, but these assets represent market indices or broad set of securities (stocks or bonds). For example, the purchase of one share of SPY (see below for description) represents

an investment into the 500 stocks in the S&P 500.

(1) SPDR S&P 500 ETF (SPY), this is a fund that mimics the performance of the S&P 500 which is a well known market index consisting of 500 large capitalization stocks from the U.S.

(2) iShares Core US Treasury Bond (GOVT), this is a fund that mimics the performance of a wide set of U.S Treasury bonds.

(3) iShares MSCI Emerging Markets Mini Vol (EEMV), this is fund that mimics the performance of emerging market stocks but with lower volatility compared to other emerging market funds.

Tasks

(a) Use yahoo (e.g. yahoo.com or yahoo.ca) Önance to get the monthly adjusted closing prices of SPY, GOVT, and EEMV from Jan 2014 to end of Jan 2021 and compute the expected returns of the three assets, the standard deviations of the three assets as well as the co-variances between all assets over this time period. Show and highlight these parameters in your report but you donít have to show the monthly prices or the computations that you did to get the parameters.

(b) Use the mean-variance optimization model to generate an e¢ cient frontier of the three assets. Create a table where for each expected return goal R show the optimal weights of the assets as well as the portfolio variance value. Also, plot the e¢ cient frontier. Note: the range of R can be the smallest positive expected return among the three assets to the largest expected return among the assets. You are free to choose the points in the range to use for the optimizations but they should be at least 10 return points equally spaced out. Matlab代写

(c) Take the minimum variance portfolio from (b) (this is the portfolio in the e¢ cient frontier with the lowest variance). Using monthly returns from only February 2021 compare the minimum variance portfolio with the equal weighted portfolio and a portfolio that has 60% in SPY, 30% in GOVT, and 10% in EEMV. Rank the 3 portfolios in terms of returns. Explain the relative performance of the portfolios.

Note: A formula sheet will be posted on the blackboard that you can use to get the parameters for PART 1 from the monthly adjusted closing prices. Matlab代写

To compute a historical monthly return for a particular month use the adjusted closing price of the last trading day of the month and use the adjusted closing

price of the last trading day of the previous month.

For example, if the adjusted closing price of the last trading day in January 2018 for a stock was $60 and the adjusted closing price of the last trading day

of February 2018 was $67, the monthly return for February is 11.67 percent [(67/60)-1] * 100.

PART 2

Repeat (b) of PART 1 using the stocks SPY, GOV, EEMV as well as the stocks below (so portfolios will have 8 assets now) that have heavy involvement and connection to development or use of blockchain technology (some people think that these stocks are going to do well in the future)

(4) CME Group (CME)

(5) Broadridge Financial Solutions (BR)

(6) Cboe Global Markets (CBOE)

(7) Intercontinental Exchange (ICE) Matlab代写

(8) Accenture (ACN)

更多代写: HomeWork cs作业 金融代考 postgreSQL代写 IT assignment代写 统计代写 代写计算机视觉论文

发表回复

要发表评论,您必须先登录。