Week 5 review questions

金融市场经济学作业代写 Consider a two asset portfolio.The overall portfolio return is 10%.The expected return on asset 2 is 7%.If 30% of the portfolio

Q1 金融市场经济学作业代写

Consider a two asset portfolio.

The overall portfolio return is 10%.

The expected return on asset 2 is 7%.

If 30% of the portfolio is invested in asset 1 and 70% in asset 2, what is the expected return of asset 1?

Q2

For the assets in Q1, now also assume that the variance of Asset 1 is 3% and variance for Asset 2 is 2%.

Plot the two assets in expected return and standard deviation space.

Q3 金融市场经济学作业代写

Let the correlation coefficient between Assets 1 and 2 equal +1. Draw the efficiency frontier on the same graph as Q2.

Q4

Now assume the correlation coefficient takes on a value less than 1. What is the shape of the frontier?

Q5 金融市场经济学作业代写

Assume now there is a risk free asset with a realised return of 5%. What is the expected return and standard deviation of this asset?

Q6

Calculate the Sharpe ratios of Assets 1 and 2

Q7

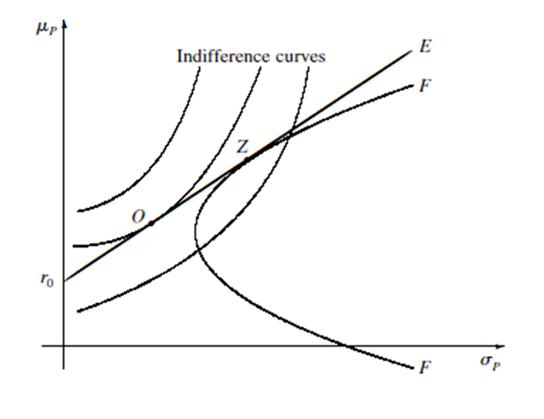

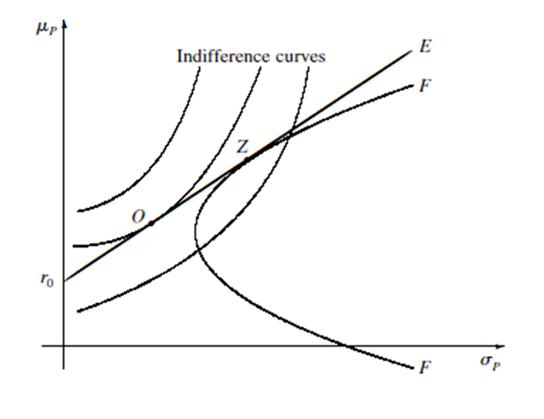

Consider the following diagram

Identify the efficient set of portfolios.

Q8 金融市场经济学作业代写

Explain by reference to the second mutual fund theorem, how portfolio O might be comprised?

Q9

Do you agree that Portfolios O and Z have the same Sharpe ratio? Explain why.

Q10

Why is Portfolio O ‘preferred’ to Z by the investor?

发表回复

要发表评论,您必须先登录。