epom407-m13-assignment.

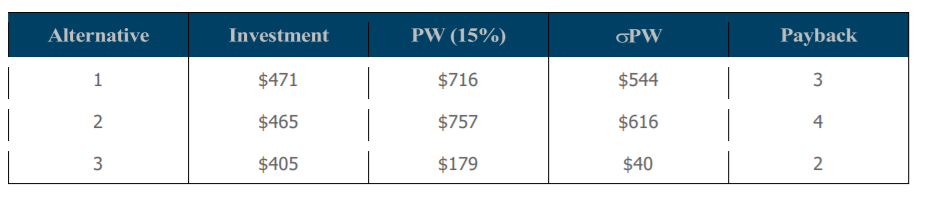

工程数据分析代写 With B = 0.01 to determine the expected utility of each portfolio for ranking. Are the results as expected, given the information

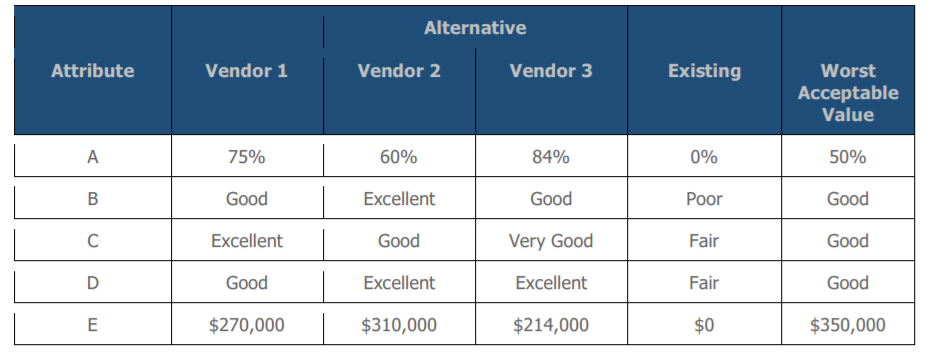

- (10 points) You try to buy a machine to replace an existing one. Three vendors make an offer and you make your selection using the following attributes: reduction in throughput time (A), Flexibility (B), Reliability (C), Quality (D), and Cost or PW of Life-cycle cost (E). Your scores of each alternative (including the existing machine) for each of the five attributes are shown below:

If relative priority for each attribute can be assessed through pairwise comparisons yielding the following results: A < B, A = C, A < D, A < E, B < C, B > D, B < E, C < D, C < E, D < E. Recommend the preferred alternative by using (a) dominance, (b) satisficing and (c) lexicography.

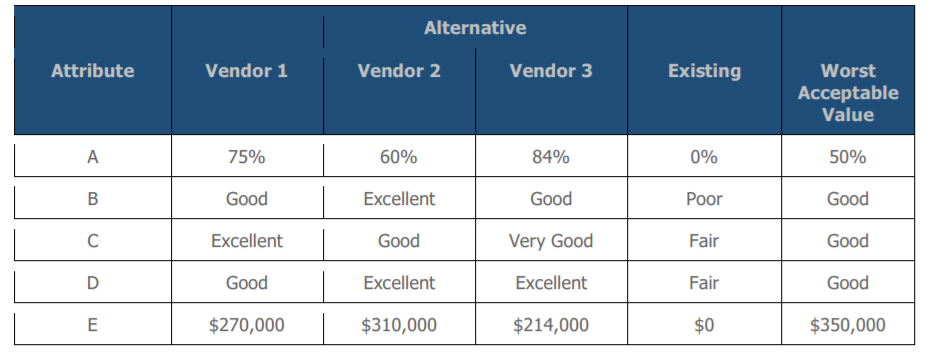

- (10 points) Three large industrial centrifuge designs are being considered for a new chemical plant. Use the data below to recommend a preferred design using the method that make the best use of the given data. 工程数据分析代写

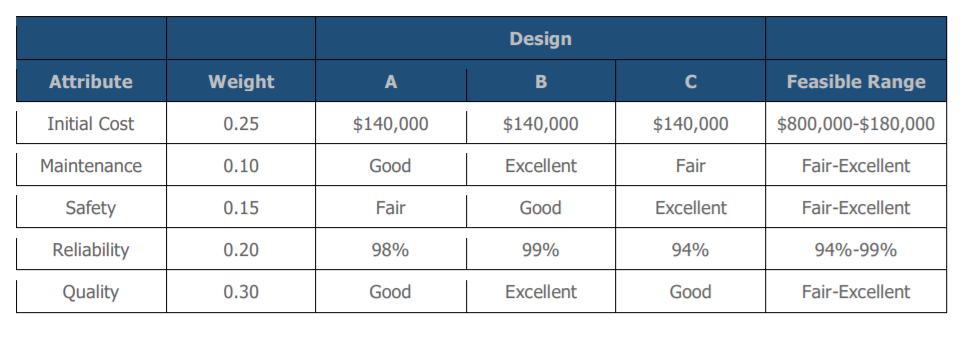

- (20 points) At the beginning of the year, Unocal Corporation announced that 2004 capital expenditures would total $1.93 billion. Planned investments included deep water exploration in the Gulf of Mexico and in the waters off Indonesia, oil and gas development in Thailand, oil development in the Caspian Sea, natural-gas development in China, and developments of the Mad Dog field in the United States and the K2 field in the Gulf of Mexico.

We seek to evaluate Unocal's numerous projects. Because individual project data are not available here, assume that information on the various projects is as given in the table below. Assume further that Unocal's capital budget is capped at $1 billion and that the projects are independent.

a. Establish the set of feasible portfolios.

b. For each portfolio, the expected present worth is the sum of the present-worth values of the individual projects, while the variance is the sum of the variances of the individual projects. (Note that the table gives the standard deviation.) Determine the expected present worth and variance for each feasible portfolio, and generate an efficiency frontier. Which portfolios are dominated?

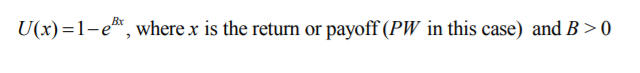

c. One way to make a risk averse decision based on the expected return E(PW) and standard deviation sPW is to use a utility function known as Freund utility function:

Assuming that the return x is normally distributed with the mean = and variance = 2, the expected utility

which is used as the final metric to compare alternatives is given by: 工程数据分析代写

With B = 0.01 to determine the expected utility of each portfolio for ranking. Are the results as expected, given the information about the efficiency frontier? How influential is B?

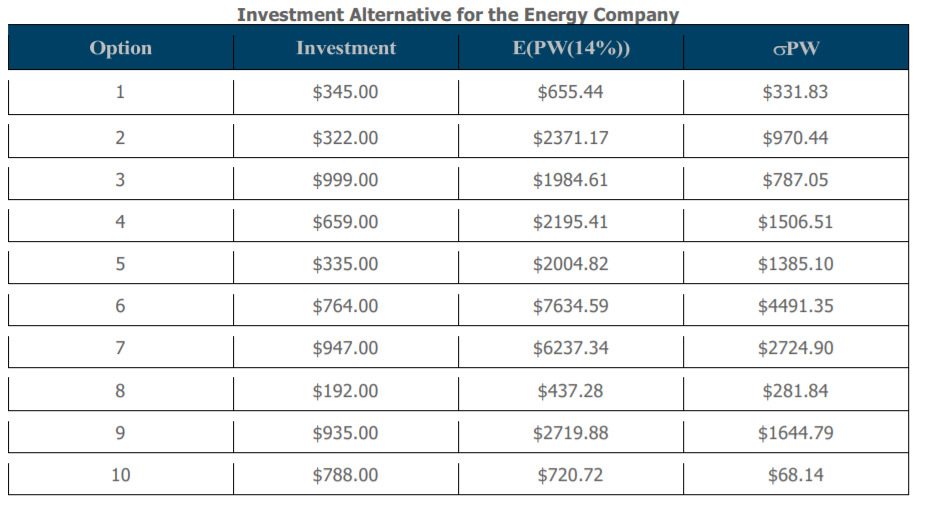

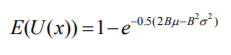

- (20 points) In 2003, a review panel from Valley Metro Rail, of Phoenix, Arizona, selected Kinki Sharyo Co. of Japan to supply cars for the Phoenix area's light rail system. The contract is for $115 million and

includes 36 railcars priced at $2.92 million each, with options on an additional 39 vehicles for the 20- mile system, planned to start operations in December 2006. Kinki Sharyo was selected over Bombardier

of Canada, Siemens of Germany, and CAF USA of Spain. The panel considered: "technical criteria, company capabilities, and price" in selecting the bidder."

Make the following assumptions: Assume that the scores for each supplier for each category are defined as in the table below. The criteria are listed in the table according to their order of importance.

For the given data,

a. Are there any suppliers that are dominated? Which suppliers make up the efficient frontier?

b. Perform a static threshold analysis, using the given standards.

c. Perform a dynamic threshold analyses, using the given standards. How do the results in (b) and (c) differ?

d. Provide a ranking of criteria by computing a score (weighted average of attribute scores that have been scaled) for each supplier.

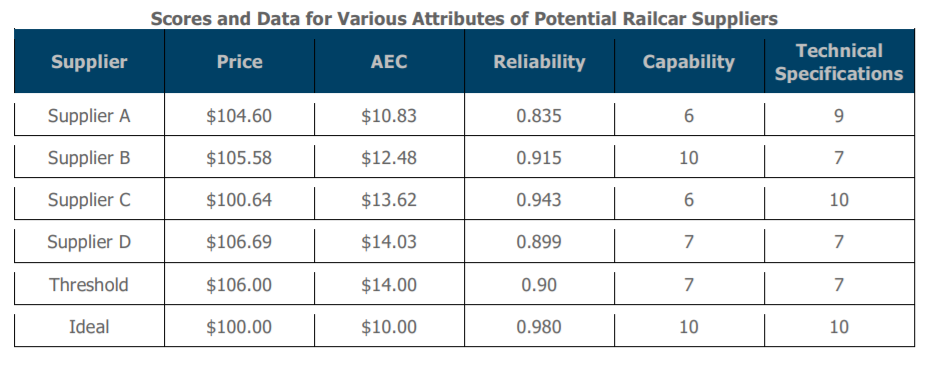

- (20 points) Consider the following list of projects (data in millions): 工程数据分析代写

Assume that all three projects are mutually exclusive.

a. Are any projects dominated? Explain.

b. Use threshold analysis with a minimum present-worth standard of maximum standard deviation of $600 million, and a maximum payback of 4 (assume that the payback period for a portfolio is the maximum payback period of any project in the portfolio). What projects should be considered?

c. Assume that the criteria of present worth, standard deviation, and payback period are ordered as listed, with ideal values of $1 billion, $20 million, and 2 respectively. Provide a score for each portfolio and select the best one.

d. Using only the PW and standard deviation, apply the Freund utility model with B = 0.05 described in Problem 3 to the portfolios to identify the best one.

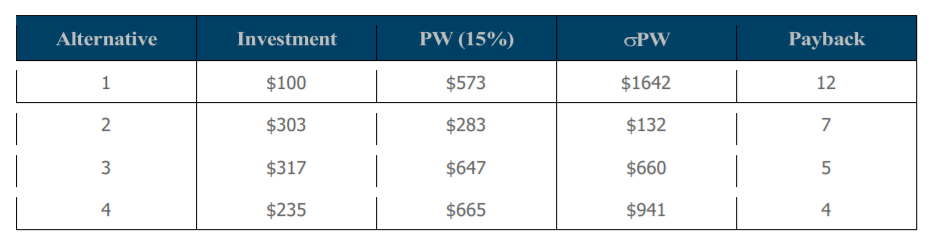

6. (20 points) Consider the following list of projects (data in millions):

Assume that projects 2 and 3 are mutually exclusive and that there is a $600 million budget.

Find the mean and variance of the present worth for all feasible portfolios. Construct an efficiency frontier. 工程数据分析代写

a. What does it tell you?

b. Use threshold analysis with a minimum present-worth standard of $0 and maximum standard deviation of $2

c. billion, and a maximum payback of 10 (assume that the payback period for a portfolio is the maximum

d. payback period of any project in the portfolio). What projects should be considered?

e. Assume that the criteria of present worth, standard deviation, and payback period are ordered as listed, with

f. ideal values of $2 billion, $125 million respectively. Provide a score for each portfolio and select the best one.

发表回复

要发表评论,您必须先登录。