Advanced Financial

Mathematics Notes

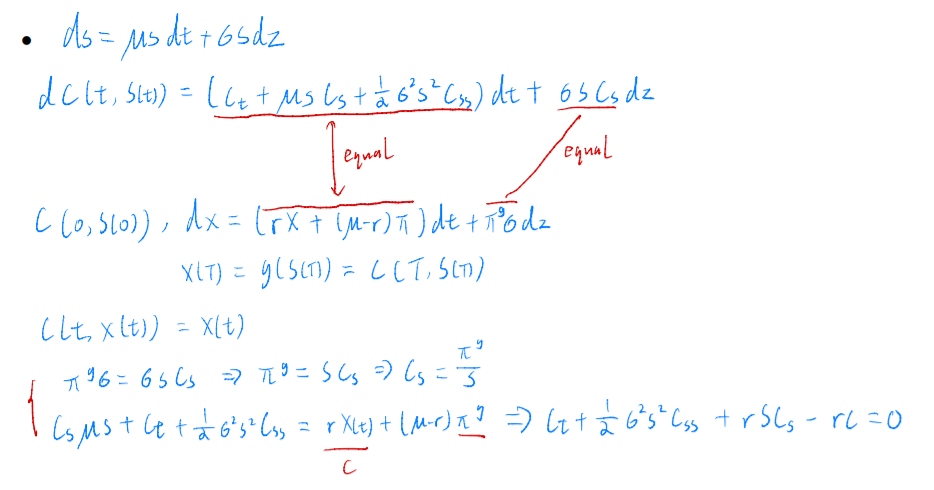

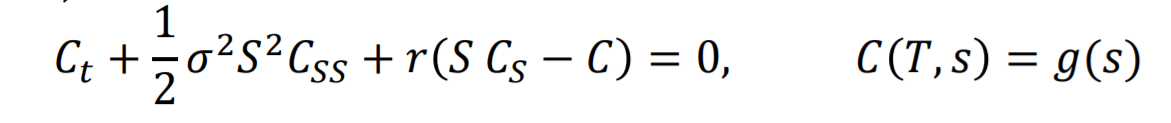

高级金融数学作业代写 Consider an option with a payoff g(S(T )).The price at time t of this option is given by C(t, S(t)), where function C is a

Feynman-Kac Theorem 高级金融数学作业代写

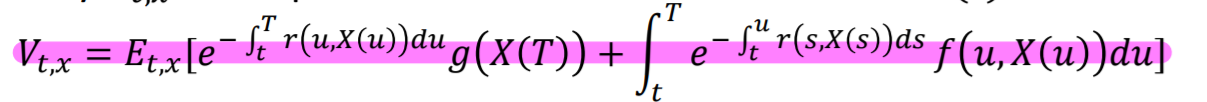

Theorem: let X be a diffusion satisfying

![]()

Denote by Et,x the expectation conditioned on the event X(t)=x

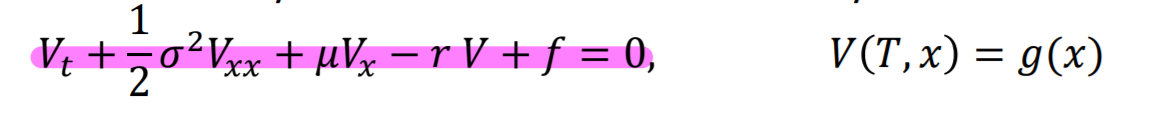

for some given functions r, g, and f . Under technical conditions, function V is the solution to the Feynman-Kac PDF and the boundary conditions 高级金融数学作业代写

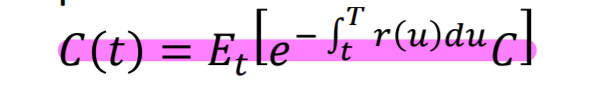

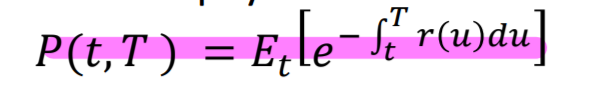

The price of a contingent claim with a random pay-off C at maturity T is computed based on Expectation Formula

The zero-coupon T -bond that pays 1 dollar at time T has the price

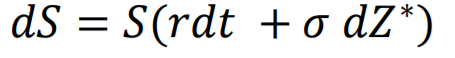

Application of Feynman-Kac 高级金融数学作业代写

- C: a contingent claim

- Then,

Black Scholes Equation

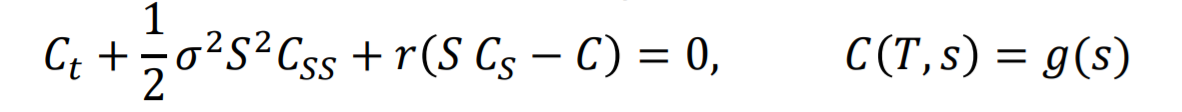

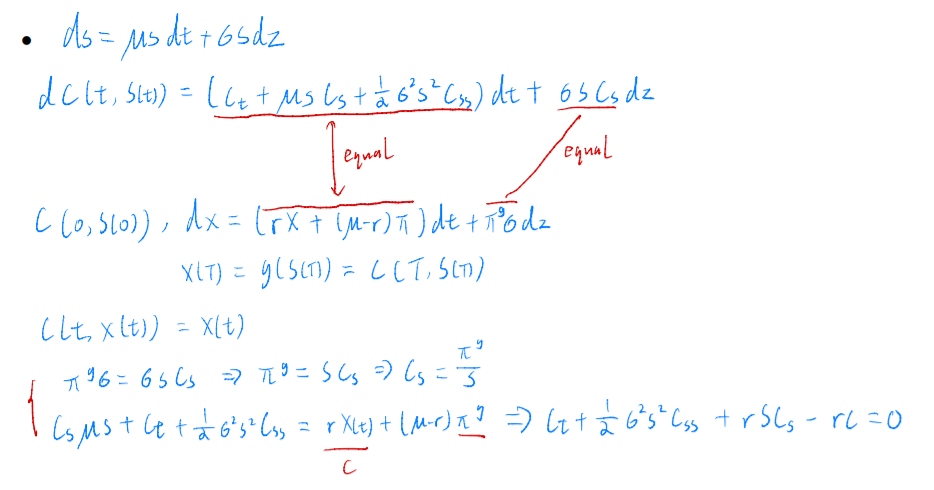

• Consider an option with a payoff g(S(T )).The price at time t of this option is given by C(t, S(t)), where function C is a solution to the

Black-Scholes PDE and the boundary condition 高级金融数学作业代写

Proof

delta of an option

![]()

the derivative of the option price with respect to the underlying, called the delta of the option, has to be equal to the number of shares of

stock held by the replicating portfolio.

更多代写: HomeWork cs作业 金融代考 postgreSQL代写 IT assignment代写 统计代写 留学生代写推荐有哪些

更多代写: HomeWork cs作业 金融代考 postgreSQL代写 IT assignment代写 统计代写 留学生代写推荐有哪些

发表回复

要发表评论,您必须先登录。