Final Exam Tutorial - QUESTIONS

ADMS 3530

金融final代考 Rogers has 48 million shares of common stock outstanding. The book value per share is $42 but the stock sells for $58. It also has

Questions 1 to 13 – Units 9, 10, 11 Review 金融final代考

1.Which of the following risks is most important to a well-diversified investor in common stocks?

- market risk

- unique risk

- total risk

- diversifiable risk

- A well diversified investor faces no risk.

2.What will happen to a stock that offers a higher risk premium than that predicted by the CAPM? 金融final代考

- Its price will decrease until its expected rate of return is pushed up.

- Its beta will decrease.

- Its price will increase until its expected rate of return is pushed down.

- Its beta will increase.

- No change as there is no relationship between the two variables.

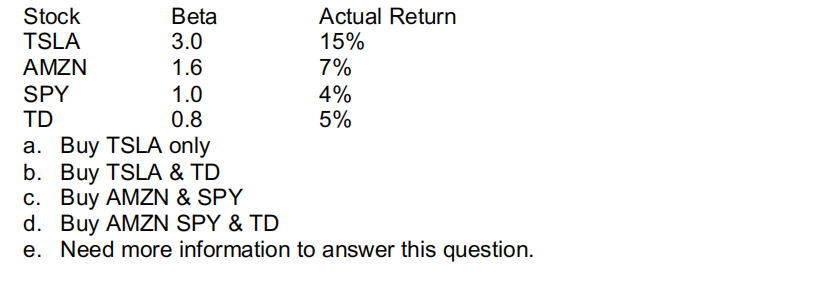

3.Which stocks should you buy if the risk-free rate is 1% and the market risk premium is 4%?

2.Need more information to answer this question.4. Brookfield Renewable Partners “TSE.BEP” is considering two projects, which projects should be accepted based on where the projects are placed on the SML?

(Rf = 1%, Rm = 5.5%)

Project Beta IRR

Solar 1.5 11%

Wind 2.5 13%

- The Solar project plots above the SML and should be accepted; the Wind project plots below the SML and should be rejected.

- The Solar project plots above the SML and should be rejected; the Wind project plots below the SML and should be accepted.

- The Solar project plots below the SML and should be accepted; the Wind project plots above the SML and should be rejected.

- The Solar project plots below the SML and should be rejected; the Wind project plots above the SML and should be accepted.

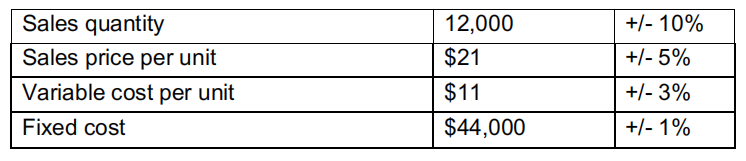

Use the following information for Questions 5 through 8 金融final代考

Rogers has 48 million shares of common stock outstanding. The book value per share is $42 but the stock sells for $58. It also has 1,000,000, 9 percent semi-annual

coupon bonds outstanding, par value $1,000 each. The bonds have 10 years to maturity and sell for 86 percent of par. Rogers common stock is half as risky as the

market portfolio and held by the general public. Rogers has 10 million shares of 5 percent preferred stock outstanding which currently sell for $63 per share which are entirely owned by the Rogers family. The face value per preferred share is $100. The T-bills yield 5.25%, and the market risk premium is assumed to be 4.15%. Rogers is in the 35% corporate income tax bracket.

5.Rogers after-tax cost of debt is: 金融final代考

- 4.53%

- 6.45%

- 6.96%

- 7.40%

- 11.54%

6.Rogers cost of equity is:

- 7.325%

- 13.55%

- 4.15%

- 10.4375%

7.Rogers cost of preferred stock is:

- 4.85%

- 5.00%

- 6.22%

- 7.94%

- 14.54%

8. What is the discount rate that Rogers should use to evaluate a project that is similar to its consolidated business? 金融final代考

- 10.54%

- 7.43%

- 11.44%

- 8.65%

- 15.55%

9.Ignoring defaults, what is the approximate effective cost of factoring if receivables are sold at a 4% discount and the average collection period is 2 months?

- 19.40%

- 24.00%

- 26.53%

- 27.75%

10.What is the cash conversion cycle for a firm with $3 million average inventories, $2.7 million average accounts receivable, $1.5 million average accounts payable, an annual cost of goods sold of $18 million, and an annual sales of $21.9 million? Please round your final answer to the nearest integer. 金融final代考

- 15 days

- 46 days

- 75 days

- 136 days

- 111 days

11.With terms of 4/15, net 60, what is the implied interest rate for forgoing a cash discount and paying at the end of the period?

- 25.63%

- 28.19%

- 39.25%

- 61.15%

12.What is the economic order quantity for an automobile dealer selling $50,000,000 of cars annually at a price of $25,000 per car, at a cost of $750 per order, and a carrying cost of $300 per car?

- 40 cars

- 71 cars

- 100 cars

- 126 cars

- 111 cars

13.As a firm’s cash conversion cycle increases, the firm: 金融final代考

- becomes less profitable

- increases its investment in working capital

- reduces its accounts payable period

- incurs more shortage costs

- starts investing in new projects

Questions 14 to 20 – Units 2 to 8 Review (40% of Final Exam questions)

14.What is the present value of a four-year annuity of $100 per year that begins two years from today if the discount rate is 9 percent?

- $297.22

- $323.86

- $356.85

- $388.97

- 451.64

15.. You are expected to pay $1,883.33 per month on a one-year loan with a principal of $20,000. What is the EAR of this loan? 金融final代考

- 13.00%

- 13.80%

- 23.19%

- 25.82%

- 16.55%

16.(Mortgage) You want to buy a house that costs $400,000. You make a 20% down payment and finance the rest with a 25-year mortgage. The mortgage has a five -ear renewal term for which the annual mortgage rate is 6.25% compounded semi-annually. What will the remaining principal of the loan be at the end of the 5-year term?

- $185,780.

- $196,670.

- $245,450.

- $288,480.

- $400,000

17.You bought a bond with a 7% annual coupon rate at its par value of $1,000 three years ago. The bond had an original maturity of 10 years. Today, the yield to maturity of the bond has increased to 8% annually. The bond pays coupons semi-annually. Assume coupons are not reinvested. What is the current yield of the bond today? 金融final代考

- 8.0%

- 7.39%

- 7.09%

- 8.39%

- 5.54%

18.Tundra Inc. has been paying out 60% of its earnings every year, and it plans to maintain its payout ratio. The company expects to earn a return on equity of 20%. The company just paid a dividend of $3 per share. The required rate of return on the stock is 12%. What is the current stock price?

- $56.78

- $72.67

- $81.00

- $25.00

- $45.45

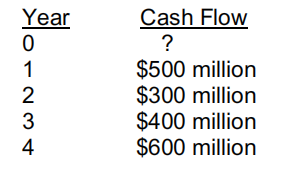

19.Oak Furnishings is considering a project that has an up-front cost and a series of positive cash flows. The project’s estimated cash flows are summarized below: 金融final代考

The project has an exact payback of 2.25 years. What is the project’s internal rate of return (IRR)?

- 17.7%

- 23.1%

- 33.5%

- 41.0%

- 65.54%

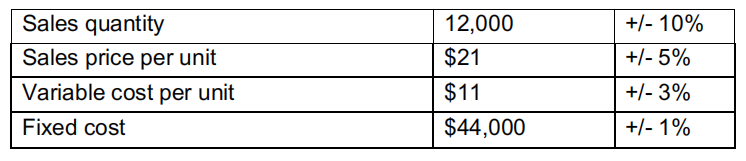

20.. You are analyzing a new project. The data on the project is as follows: 金融final代考

Initial investment: $80,0000

Depreciation: Straight-line to zero over the two-year life of the project.

(ignore the half-year rule)

Required rate of return: 12%

Marginal tax rate: 34%

What is the net present value of the project under the best-case scenario?

- $59,209

- $61,952

- $64,695

- $67,107

更多代写:

更多代写:

发表回复

要发表评论,您必须先登录。