Sample Examination

金融管理exam代考 Tracking Error can be calculated Either by running an OLS regression of a fund/portfolio against its benchmark OR by calculating

Question 1

Hedge Funds invest in all assets, use long and short investment strategies, as well as using leverage

and derivatives. Which of the following statement is incorrect?

- a) Hedge Funds use long and short positions to increase or decrease risk

- b) Hedge Funds use long and short positions to gain from mis-priced investments

- c) Hedge Funds use short positions to gain from undervalued investments.

- d) Hedge Funds use leverage to increase investments in risky assets.

- e) Hedge Funds use derivatives to increase or decrease risk

Question 2 金融管理exam代考

The inputs to a Mean-Variance framework in Excel Solver include all of the following except:

- a) Expected return using historical mean and variance of every asset/sub-asset class

- b) Historical standard deviation of each asset/sub-asset class

- c) Term structure (yield curve) of the local market.

- d) Historical average return of each asset/sub-asset class

- e) Historical covariance of every asset/sub-asset class with every other asset/sub-asset class

Question 3 金融管理exam代考

Portfolio managers who wish to analyse how a portfolio's risk will be impacted by variation in the

risk of one variable at a time will use:

- a) Stress testing

- b) Moving averages of portfolio returns adjusted for spending

- c) Scenario analysis adjusted for spending

- d) Back (historical) testing adjusted for spending

- e) Out-of-sample testing adjusted for spending

Question 4

Tracking Error can be calculated Either by running an OLS regression of a fund/portfolio against its benchmark OR by calculating the standard deviation of the difference in returns between the Fund/portfolio and its Benchmark. Tracking Error calculated by running an OLS regression of the fund/portfolio against its benchmark will be a _____________ value than when calculated using the standard deviation of the difference in returns between a fund/portfolio and its benchmark, because ___________________________.

- a) lower; OLS regressions minimise the sum or square of errors.

- b) lower; OLS regressions adjusts for the degrees of observations

- c) higher; OLS regression adjusts for the beta

- d) same; tracking error is generated by creating the portfolio different from the benchmark and has no relevance on the methodology of calculation

- e) same or higher; OLS regressions are affected by multi-collinearity

Question 5 金融管理exam代考

The Capital Asset pricing Model (CAPM) relates the _______________ risk of an investment with the

expected return on that investment because______________________________________.

- a) systematic ; unsystematic risk can be diversified away.

- b) systematic, because systematic risk can be diversified away

- c) total, because unsystematic risk cannot be diversified away

- d) total; because systematic risk can be diversified to a limit

- e) unsystematic; because unsystematic risk can be diversified to a limit.

Question 6 金融管理exam代考

Which of the following statements is incorrect regarding Risk Parity portfolios and Risk Allocated portfolios?

- a) Risk Parity portfolio ensure that the marginal contribution to risk is equal for each asset in the portfolio. Risk allocated portfolios ensure that investments with the highest risk have the highest allocation.

- b) Both allocation methods allocate risk based on a pre-determined basis.

- c) Once portfolios are constructed based on either methodologies, one methodology may result in lower overall risk than the other.

- d) Once portfolios are constructed based on either methodologies, one methodology may result in a more efficient allocation than the other.

- e) Once portfolios are constructed based on either methodologies, one methodology may result in a higher overall return than the other.

Question 7

Which of the following statements is incorrect regarding Active and Passive Investment strategies?

- a) Active investment strategy will always outperform a capitalization weighted index/passive investment. Assume the index is an appropriate benchmark for the active strategy. 金融管理exam代考

- b) Active investment strategy will most likely will have a higher standard deviation of returns (Volatility) compared with a capitalization weighted index/passive investment. Assume the index is an appropriate benchmark for the active strategy.

- c) Passive strategies are easier to implement as they do not require to value any of the investment, rather they use investment weights obtained from the index providers through a licensing arrangement.

- d) Active strategies are more difficult to implement as they do need to value investments and/or forecast sectors performance.

- e) The most used (in practice) passive investment methodologies include capitalization based allocation, price based allocation, and equal weighting.

Section B – Short Answer Questions

Question 1 金融管理exam代考

This question relates to the understanding of Hedge Funds.

- a) Explain why are Hedge Funds considered Alternative Investment Class?

- b) Explain why Hedge Funds are difficult to value compared to listed Equity or Bond securities.

- c) Why does valuation difficulties result in agency cost?

Question 2

Explain what is a growth investment strategy? Please explain why both large capitalised equities and small capitalised equities may be selected in a growth investment fund? Further explain how Value and Growth Funds identify undervalued securities.

Question 3

Conservative investors prefer to restrict portfolio managers' risk taking by keeping narrow ranges around asset classes and asset groups. For example, if the SAA allocates 20% to bonds, then a range of 18% to 22% for bonds is considered narrow compared with a range of 10% to 30%. Explain why narrow TAA ranges will result in tighter risk control?

Question 4 金融管理exam代考

An investor wishes to understand the difference between dollar-based asset allocation and risk based asset allocation.

Required:

(i) Explain why asset allocation weights differ under the two methodologies.

(ii)Explain which allocation methodology is better suited to create a well-diversified portfolio.

Question 5

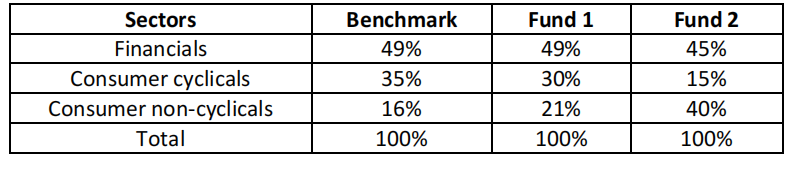

The sector allocation of two funds and their benchmark was obtained on the 1st of July and are as follows:

Based on the above asset allocation and assuming that these asset allocations are established for the next 3 months, please answer the following questions:

- a) Explain: 金融管理exam代考

(i) if the funds in the table above (Fund 1 and Fund 2) are managed actively or passively.

(ii) Now explain which fund will have higher Tracking Error.

- b) Explain which fund is optimistic regarding the economy (expects the economy to improve).

更多代写:cs代写 计量经济代考 机器学习代写 r语言代写 summary怎么写

更多代写:cs代写 计量经济代考 机器学习代写 r语言代写 summary怎么写

发表回复

要发表评论,您必须先登录。