FMI SampleExam PartB

金融市场和机构代考 National Cleaner Corp. needs a $1.5 million loan to finance a project that pays off next period. There are two projects

When collateral is used as a screening device in conjunction with nterest rate, a high risk borrower chooses a contract with ___ , while a low risk borrower chooses the one with ___ . 金融市场和机构代考

A. high collateral-high interest rate, low collateral-low interest rate

B. low collateral-low interest rate, high collateral-high interest rate

C. high collateral-low interest rate, low collateral-high interest rate

D. low collateral-high interest rate, high collateral-low interest rate

The reason why a bank would ration credit is that

A.the interest rate has fallen so low that lending to any borrower would not be profitable

B.the increase in the loan rate worsens moral hazard problem between the bank and the borrower

C.the bank’s expected profit could be lower at a higher loan rate because of adverse selection problem

D.none of the above

A long-term bank-borrower relationship can result in 金融市场和机构代考

A.the bank being exploited by the borrower due to a more severe, multi-period asset substitution moral hazard problem

B.the reduction in moral hazard when a binding multi-period contract can be negotiated at the outset

C.the borrower’s lesser propensity to switch project because it’s being offered a subsidized loan after it repays its first period loan

D.none of the above

Due to the sequential service constraint and the undefined maturity features, the bank

A.can costlessly raise money to satisfy withdrawals by informed depositors who may have detected a fraud.

B.can costlessly liquidate the loans to satisfy withdrawals by informed depositors who may have detected a fraud.

C.will be deterred from engaging in behaviors that give rise to moral hazard problems.

D. will be encouraged to undertake riskier projects to increase shareholders’ wealth.

Due to the option feature of the deposit insurance, a higher deposit insurance premium should be imposed on 金融市场和机构代考

A.banks that have high interest rate risk.

B.banks that have high capital to total assets ratio and low volatility of asset values.

C.banks that have low capital to total assets ratio and high volatility of asset values.

D.banks that have low loan loss reserves.

National Cleaner Corp. needs a $1.5 million loan to finance a project that pays off next period. There are two projects available, A and B. You are a lending officer and know about the projects but cannot control the borrower’s project choice. A will yield a payoff of $6.75 million with probability 0.6 or zero with probability 0.4. B will pay off $8 million with probability 0.5 or zero with probability 0.5. 金融市场和机构代考

Everybody is risk neutral and the riskless interest rate is 10%. You consider designing a loan contract that involves the use of collateral However, collateral is costly and $1 of the borrower’s collateral is worth only 90 cents to your bank. Suppose you assume that A will be chosen, and offer an unsecured loan. What project will the firm choose and what is the interest rate?'

A.Project A with net expected payoff $6.75 million, interest rate 10%

B.Project A with net expected payoff $2.4 million, interest rate 83.33%

C.Project A with net expected payoff $2.25 million, interest rate 57%

D.Project B with net expected payoff $2.625 million, interest rate 83.33% Solution

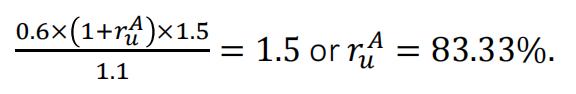

- Under the assumption that A will be chosen, the loan rate solves

- Choosing A yields an expected payoff = 0.6 [6.75 – 1.8333 1.5] = $2.4 million.

- Choosing B yields an expected payoff = 0.5 [8 – 1.8333 1.5] = $2.625 million.

- Thus, the firm will choose B.

发表回复

要发表评论,您必须先登录。