ECMT6006 2021S1 Assignment

经济学Assignment代写 Compute the arithmetic net returns and log returns. Generate a time series plot of each of these returns. Put a clear title

Please compile your solutions in ONE file (not including the program code which you can submit separately) and submit it via Turnitin in Canvas. You can either handwrite or type your answers. For the empirical questions, please present the figures and provide your analyses/interpretations properly. If you use MATLAB, you can present your answers using livescript exported in a document format. Except for special circumstances, I DO NOT accept late submission.

Note: Patton (2019) refers to the reference textbook by Andrew Patton. 经济学Assignment代写

Question 1. Question 1 in Section 1.10.2 on Page 44 in Patton (2019).

Question 2. Question 2 in Section 1.10.2 on Page 44 in Patton (2019).

Question 3. Question 3 in Section 1.10.2 on Page 45 in Patton (2019).

Question 4. In this question, you will use time series of daily prices on two financial assets: the S&P500 index1 and the USD/Euro exchange rate2 . Use at least two years of data to answer the following.

(i) Convert the prices into continuously compounded returns. Generate a plot of each of these returns. Put a title, x-axis label and y-axis label on the figures.

(ii) Denote the returns of S&P500 index as Y and the returns of USD/Euro exchange rates as X. Answer questions (a)–(e) of Question 2 in Section 1.10.3 on Page 47–48 in the textbook.

Question 5. You can find the daily and monthly stock prices of Microsoft Corp. from March 1986 to December 2017 in the attached data files3 . Assume there is no dividend payoffs for simplicity. Work on the following questions for both daily and monthly series. 经济学Assignment代写

(i) Generate a time series plot of each of the price series. Put a clear title, x-axis label and y-axis label on your figures.

(ii) Compute the arithmetic net returns and log returns. Generate a time series plot of each of these returns. Put a clear title, x-axis label and y-axis label on your figures.

(iii) For both arithmetic net returns and log returns, compute the summary statistics including maximum, minimum, median, mean, standard deviation, skewness, excess kurtosis. Brieftly describe the empirical characteristics of the returns in words.

(iv) Are the sample means of these return series statistically different from zero? Use a simple t-test at the 5% significance level to draw your conclusion.

(v) Obtain the histogram of each of the return series, and compare it with the normal distribution that has the same mean and standard deviation.

Question 6. Question 1 in Section 4.8.2 on Page 134 in Patton (2019). 经济学Assignment代写

Question 7. Question 3 in Section 4.8.2 on Page 136 in Patton (2019).

Question 8. Consider the below three asset return time series:

• daily log returns of Microsoft Corp stock used in Problem 5;

• daily log returns of S&P500 index used in Problem 4;

• daily log returns of USD/Euro exchange rate used in Problem 4. Complete the following:

(i) Generate the sample autocorrelation functions (up to 20 lags) for these returns and plot them.

(ii) Generate the sample autocorrelation functions (up to 20 lags) for these returns squared and plot them.

(iii) For each return and squared return series, conduct a Ljung-Box test for L = 5, 10, 20 where L is the number of lags considered in the joint test.

(iv) For each return and squared return series, conduct a robust joint test for the serial correlation based on a linear regression with White and NeweyWest standard errors. Again, consider L = 5, 10, 20 where L is the number of lags considered in the joint test. 经济学Assignment代写

(v) What do you learn from (i)–(iv)?

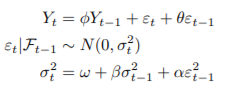

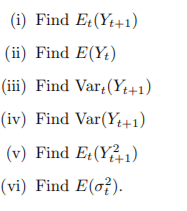

Question 9. Consider the following ARMA(1,1)-GARCH(1,1) process 经济Assignment代写

where |φ| < 1 and α + β < 1. Assume {Yt} is weakly stationary. Answer the following.

Question 10. Question 2 in Section 5.10.2 on Page 185 in Patton (2019) 经济学Assignment代写

更多代写:cs代写 计量经济代考 机器学习代写 r语言代写 代写经济学essay

发表回复

要发表评论,您必须先登录。