MATH0051: Analysis 4 — Real Analysis

真实分析代写 Hence, in addition to the 5,000 traded options, a short position in £2,550 is necessary so that the portfolio is both vega and delta

a)The proportional change in the value of the portfolio resulting from the specified shift is: 真实分析代写

−(0.2 × 9e + 0.6 × 8e + 0.9 × 7e + 1.6 × 6e + 2 × 5e – 2.1 × 3e – 3 × 0) = −26.2 e

- 2.The delta of the portfolio is−1, 000 × 0.50 − 500 × 0.80 − 2,000 × (−0.40) − 500 × 0.70 = −450

The gamma of the portfolio is

−1, 000 × 2.2 − 500 × 0.6 − 2,000 × 1.3 − 500 × 1.8 = −6,000

The vega of the portfolio is

−1, 000 × 1.8 − 500 × 0.2 − 2,000 × 0.7 − 500 × 1.4 = −4,000

a) A long position in 4,000 traded options will give a gamma-neutral portfolio since the long position has a gamma of 4, 000 × 1.5 = +6,000. The delta of the whole portfolio (including traded options) is then: 真实分析代写

4, 000 × 0.6 − 450 = 1, 950

Hence, in addition to the 4,000 traded options, a short position in £1,950 is necessary so that the portfolio is both gamma and delta neutral.

- b)A long position in 5,000 traded options will give a vega-neutral portfolio since the long position has a vega of 5, 000 × 0.8 = +4,000. The delta of the whole portfolio (including traded options) is then

5, 000 × 0.6 − 450 = 2, 550

Hence, in addition to the 5,000 traded options, a short position in £2,550 is necessary so that the portfolio is both vega and delta neutral.

Section B 真实分析代写

- 1.

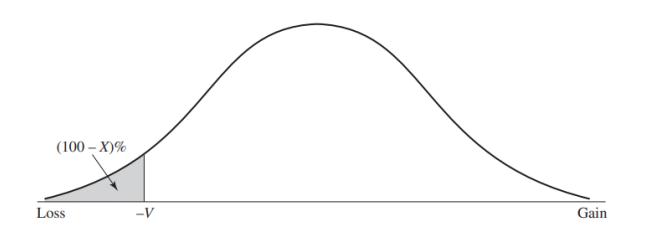

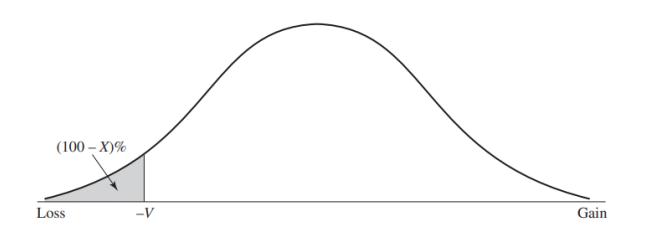

Value-at-Risk (VaR) is a loss level such that we are X percent certain that we will not lose more than V dollars in time T. The variable V is the VaR.

VaR can be calculated from the probability distribution of profits (including gains and losses) during time T. As illustrated in the probability distribution of profits plot below, the larger losses are more on the left and the larger gains are more on the right. The loss point (-V) is corresponding to cumulative probability of (100-X) (left part of the plot). Therefore, we are X percent sure the profits are larger than V (right part of the plot)

VaR has shortcomings as follow:

- a) VaR answers the question “How band can thinks get”. However, it does not provide information on “Ifthings do get bad, what is the expected loss??” that is, the amount of larger and extreme losses hidden in the left part of the plot. VaR does not provide enough information about tail risk and therefore it is not that useful in extreme market conditions.

- To overcome this drawback, we introduce the concept of expected shortfall (ES), which is the expected loss during time T conditional on the loss being greater than the VaR by examining the probability distributions of the left part of the plot.

- Stressed VaR can also be used based on calculations on movements during a period in the past that would have been particularly bad for the current portfolio.

b) VaR is not a coherent risk measure tools because it does not satisfy the subadditivity condition. 真实分析代写

- Spectral risk measures (i.e. exponential spectral risk measures) can overcome this problem.by assigning weights: the weight assigned to the qth percentile of the loss distribution is a nondecreasing function of q.

- c) Sometimes VaR is calculated based on historical method or VCV matrix using normal distribution method. However, the historical data may not happened in the future and the profits probability distribution is not always true in the real world.

Monte-Carlo simulation VaR can be used by generating hundreds of thousands of potential outcomes and calculating VaR based on that. Also, other distribution can be used to replace normal distribution, for example the destructions with large tail.

2. Liquidity black holes refers to a condition that most market participants

want to be on the same side of the market at the same time.Hedge funds are not regulated in the same way as other financial institutions. It is therefore possible that they improve liquidity because they want to do different trades from other financial institutions. However, hedge funds are themselves big players in some markets. Hedge funds tend to follow similar trading strategies to each other.

As a result, they respond in the same way to market events and can create (or make worse) black holes. (The LTCM situation in 1998 provides an example here.) Also hedge funds are reliant on leverage. When prime brokers cut their lines of credit, they all tend to have to close out positions at the same time. (This happened in 2007.) 真实分析代写

发表回复

要发表评论,您必须先登录。