Project Appraisal Techniques

工作分配管理代写 Project one has a positive profitability index compared to project two, which has a negative Profitability Index. Hence

Introduction 工作分配管理代写

GrubHeven is a listed company that deals with the manufacturer of food products. In recent years, the issue of the increased wastage of food products has been a significant concern to the firm since it leads to high losses. The firm's management realizes the same they want to engage in the processing and conversion of the fruits into flour that can later be added to drinks, baked goods, and other products.

This is a preventive measure of reducing the high wattage so that the firm makes the high revenue expected at the end of the accounting period. GrubHeven firm has two projects in hand, and they must be appraised using the different techniques to determine the most profitable and suitable project to be undertaken.

There are two types of investment: the independent and the mutually exclusive project. Mutually exclusive projects are the projects that are substitutes for each other, and they compete for the available resources; when one is undertaken. 工作分配管理代写

The other one cannot be undertaken.

Independent projects serve different functions and do not compete for the available resources; the benefits of one project do not affect the other project, and a firm can consider undertaking all the projects simultaneously (Wilson, 2020). In our case study of the GrubHeven firm, the projects are mutually exclusive. The firm can only undertake one of the projects; hence the question will determine the most suitable project.

The basic types of investments are maintenance, new products or services, expansion of the existing products or services, and mandatory investment; in the case study, GrubHeven wants to undertake the production of new products, that is, the conversion of the fruits into powders as a preservative measure (Borad, 2022). 工作分配管理代写

The new product will pass through the four cycles on the introduction to the market: the introduction, growth, maturity, and decline stages, respectively. During the introduction, there were few sales since the product was new in the market, and many of the consumers were not aware of the product. At the same time, at the growth, there is a higher sales than the introduction stage since the new product is familiar in the market. There are the highest sales at the maturity stage since many consumers are aware of the product through marketing and branding.

Last but not least is the decline stage, where the levels of sales decline and the revenue generated are trim, and the process repeats itself in the cycle. Since GrubHeven is considering investing in a new product, the management should ensure good marketing and branding to facilitate easy sales. Grubheven firm will generate high revenue in return.

Literature review 工作分配管理代写

There are the features of a good appraisal technique: it must consider the concept of the time value of money by discounting all the cashflows and give the decision criteria of either accepting or rejecting the proposed projects.

Furthermore, the appraisal techniques should not be rigid and hence should be flexible and applicable in all the projects and must also use the accounting cash flow rather than the accounting profits of the firm. Again, a good technique should recognize that a more significant cash flow is preferable to smaller ones. Early cash flows are preferable to the later ones and should also provide the projects' ranking based on the projects' economic desirability.

There are two main investment appraisal techniques discounted and non-discounted techniques. The discounted techniques are payback and the internal rate of return method, while the non-discounted ones include: Present Net Value, Profitability Index, and Internal Rate of Return.

(i) payback method

The number of years a firm takes to recover the original amount invested (Gocardless, 2020). 工作分配管理代写

Payback period= original amount invested /uniform cashflow

And if the cash flow is not constant

Payback period =no years before full recovery +cash balance to the payback/cash received the following year.

The criteria used to decide to undertake a project under this technique are that the selected project takes the shortest time (Javed, 2020).

advantages of using the payback period technique to evaluate the projects 工作分配管理代写

Easy to understand even for the persons with no financial knowledge.

Assesses the liquidity of a project.

Easy to calculate and use in appraising the projects.

Disadvantages of using the payback period technique to evaluate the projects

Does not consider the time value of money.

The techniques ignore all the cash flows after the payback period (CFI, 2020).

(ii)Accounting Rate of Return (A.R.R) 工作分配管理代写

The technique takes the average annual income produced by an asset, then divides that amount by the actual expenses (Bragg & Bragg, 2022).

A.R.R.= Average Annual Profit /Average Investment *100

Average Investment= (Book value at year1+scrap value)/2

The advantages of using the accounting rate of return technique for project appraisal

It is easy to derive and appreciate the payback model over the fiscal life of the project (CFI, 2021).

It respects the idea of net earnings (earnings after tax and depreciation)

It brings out the viability of the project (GOCARDLESS, 2022).

It considers the interest of shareholders, that is, wealth maximization.

Disadvantages of using the accounting rate of return technique for project appraisal 工作分配管理代写

It gives different outcomes when one calculates R.O.I. and another calculates A.R.R., hence the difficulty in decision making (Henricks, 2020).

It does not take into consideration of the time factor.

It does not acknowledge other factors that affect the project's success.

(iii)Net Present Value Method

This is the value of all future generated cash flows from the project; its entire economic life is discounted to the present value of the project (Boundless Finance, 2022). 工作分配管理代写

Net Present Value= present value of cashflow- initial cost of the project

Advantages of using the net present value technique

It is a straightforward and easy appraising project (Javed, 2021).

Net present value takes into account the time value of money

The appraisal technique considers all the financial information relevant to the decision of the entire investment period (Javed, 2021).

Disadvantages of using the net present value technique 工作分配管理代写

It assumes the discount rate selected is constant over the project's economic life.

It is an inaccurate appraisal technique since the forecasted cash flow may be erroneous.

It is difficult to estimate the cost of capital accurately,

An absolute measure like N.P.V is less easy to comprehend than a relative measure like a rate of return on investment.

The sources of capital of a firms

There are different ways in which a firm can fund its activities, and they include the owner’s capital, which is the capital that the owner or the manager has that can finance the business idea (CFI, 2020). Some of the advantages of the owner's capital are that it is quick and convenient to use since there is no involvement of the third party, there is no borrowing of capital, and hence there is no payment of the principal amount or the interest on the loan. 工作分配管理代写

The cons of owner capital are that the owner might not have enough capital to finance the business idea, and once the money is used, it is not repaid to the owner. Again, a firm can consider selling either the non-current or current assets to the fiancé the investment idea (C.F.A., 2022).

One of the advantages of this method is that it can be a quick method of acquiring capital since the disposal process of the asset is fast in the market and can also create money for profitable investment opportunities. Some of the disadvantages of selling the assets are that some assets may be sold at a loss after failing to get total market value, and some assets sold might be needed in the future by the institution.

Furthermore, the firm may consider selling or issuing the preference and ordinary share to the investor at a specific price. 工作分配管理代写

And they will become its shareholders (Carbajo, 2020). Some of the advantages of using them are that it is a fast and efficient way of acquiring capital quickly and the shares issued are not paid back with any interest.

Some of the disadvantages of issuing the shares are that the management loses control of the investment since the shareholders control it; again, the business is at risk of takeovers. The shareholder is obligated to receive dividends at the end of the accounting period. Again, the firm may consider acquiring loans from a financial institution and either the short term or long-term to finance the investment opportunity. The loan is paid back with some interest.

The advantages of taking a loan are that it is quick and easy to acquire. The firm can acquire a considerable amount of capital provided it has valid security. The disadvantages of taking a loan are paid back with some interest. It is also challenging to acquire a loan without valid security, especially for new businesses. The most appropriate funding source for the GrubHeven firm is the bank loan because the business idea has a good return, and after a short period, the principal and the loan will be repaid.

Appraisal techniques of the GrubHeven projects.

1.Net Present Value

GrubHeven firm will use the Present Net Value and the internal rate of return to evaluate the two projects, and the most profitable one will be chosen.

Project one.

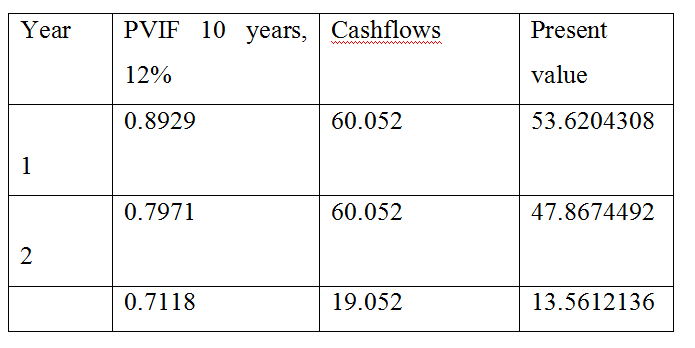

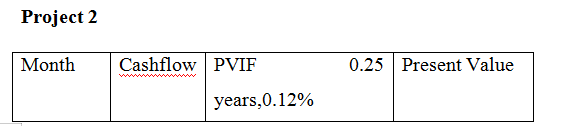

Using the Net present value, the return of the project will be as follows 工作分配管理代写

Net Present Value= present value of cash flow- initial cost of the project (CFI, 2022).

From the above calculation, the return on the investment using the N.P.V. method is million; 227.680408; hence after undertaking the ten years of the project, the value realized is 227.680408.

After the seven months of undertaking project 2, the Present Net Value is 32,421,580

Some of the problems associated with the N.P.V method. 工作分配管理代写

- The method may be prone to errors since it involves forecasting the cash flows, and the process is inaccurate.

- It is tiresome to estimate the cost of capital.

3 The absolute measure of the N.P.V. may be unsuitable for ranking projects when the initial capital is scarce.

- Profitability Index

It is the relative measurement of a business's profit calculated by dividing the Cashflows by the project's initial cost.

- I= Present Value of cashflows/ Initial cost of the investment.

Project 1

| Year | PVIF 10 years, 12% | Cashflows | Present value |

| 1 | 0.8929 | 60.052 | 53.6204308 |

| 2 | 0.7971 | 60.052 | 47.8674492 |

| 3 | 0.7118 | 19.052 | 13.5612136 |

| 4 | 0.6355 | 65.464 | 41.602372 |

| 5 | 0.5674 | 65.464 | 37.1442736 |

| 6 | 0.51 | 65.464 | 33.16 |

| 7 | 0.4523 | 77.928 | 35.2468344 |

| 8 | 0.4039 | 77.928 | 31.4751192 |

| 9 | 0.3606 | 77.928 | 28.1008368 |

| 10 | 0.322 | 80.428 | 25.897816 |

| 347.680408 | |||

| Initial investment | 120 | ||

| Profitability Index | 2.897336733 |

Case study one has a profitability index of 2.897336733.

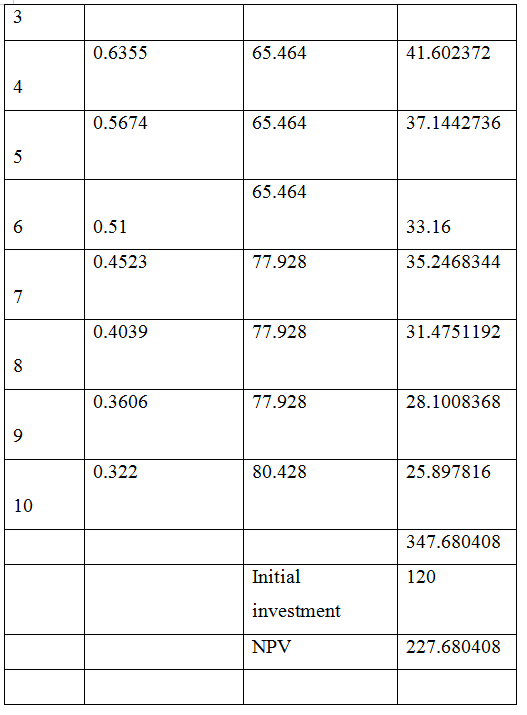

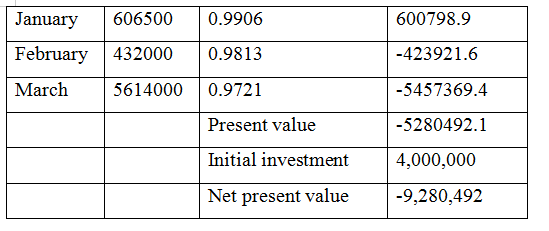

Project 2 工作分配管理代写

Project 2 profitability index will be calculated as follows:

| Month | Cashflow | PVIF 0.25 years,0.12% | Present Value |

| January | 606500 | 0.9906 | 600798.9 |

| February | 432000 | 0.9813 | -423921.6 |

| March | 5614000 | 0.9721 | -5457369.4 |

| Present value | -5280492.1 | ||

| Initial investment | 4,000,000 | ||

| Profitability Index | -1.320123025 |

Project one has a positive profitability index compared to project two, which has a negative Profitability Index. Hence, GrubHeven may consider undertaking project one and undergoing project two.

Advantages of the Profit Index Appraisal Technique

- It is easy to calculate and interpret.

- The techniques acknowledge the time value of money.

Disadvantages of Profit Index Appraisal Technique 工作分配管理代写

- Estimating the cash flow is a requirement, hence a tedious appraisal technique.

- There is the assumption that the cost of capital is constant during the life cycle of the project, which is inaccurate

- The method is erroneous since it requires estimating the cost of capital.

Internal rate of return

It uses the principle of NPV and equates the current cash flow to the initial cost of the investment.

IRR= r% + +NPV/Absolute sum of the NPVs(R%-R%)

Project one

The project, one using the IRR technique

| Year | PVIF 10 Years, 46% | Cashflows | Present value |

| 1 | 0.684931507 | 60.052 | 41.13150685 |

| 2 | 0.469131169 | 60.052 | 28.17226497 |

| 3 | 0.321322719 | 19.052 | 6.121840434 |

| 4 | 0.220084054 | 65.464 | 14.4075825 |

| 5 | 0.150742503 | 65.464 | 9.86820719 |

| 6 | 0.103248289 | 65.464 | 6.759046021 |

| 7 | 0.070718006 | 77.928 | 5.510912809 |

| 8 | 0.048436991 | 77.928 | 3.774597814 |

| 9 | 0.033176021 | 77.928 | 2.585340969 |

| 10 | 0.022723302 | 80.428 | 1.827589741 |

| 120.1588893 | |||

| Initial investment | 120 | ||

| NPV(Positive) | 0.158889289 |

| Year | PVIF 10 Years, 47% | Cashflows | Present value |

| 1 | 0.680272109 | 60.052 | 40.85170068 |

| 2 | 0.462770142 | 60.052 | 27.79027257 |

| 3 | 0.31480962 | 19.052 | 5.997752889 |

| 4 | 0.214156204 | 65.464 | 14.01952176 |

| 5 | 0.145684493 | 65.464 | 9.537089636 |

| 6 | 0.099105097 | 65.464 | 6.487816079 |

| 7 | 0.067418433 | 77.928 | 5.25378368 |

| 8 | 0.04586288 | 77.928 | 3.574002503 |

| 9 | 0.031199238 | 77.928 | 2.43129422 |

| 10 | 0.021223971 | 80.428 | 1.707001575 |

| 117.6502356 | |||

| Initial investment | 120 | ||

| NPV(Negative) | -2.349764403 |

IRR= r% + +NPV/Absolute sum of the NPVs(R%-R%)

46%+0.158889289/-1.0954(47% -46%) 工作分配管理代写

The IRR for project one is 45.85%

Project one has a positive IRR of 45.85% higher than the cost of capital, and hence GrubHeven should undertake a project and forego project one.

January to March forecasted budget 工作分配管理代写

| January to March budget | |

| Purchases | 15800000 |

| Rent | 720000 |

| Fixed Cost | 3000000 |

| Variable costs | 2250000 |

| Finance interest | 30000 |

| Total budget | 21800000 |

The forecasted budget for January up to March was as follows. The total amount required is estimated to be 21,800,000; however, this is only an estimation that the amount can rise or fall slightly.

Break-even analysis

The break-even analysis is the point whereby the Total revenue = Total expenses, and hence the firm is making zero profit. For the three months that is from January to March, the break-even point will be determined using the graph as follows:

At the point of the intersection, the break-even point is in February and at a value of 5,300,000.

Other factors to be considered before undertaking the projects

The most suitable project is the projected one from the appraisal techniques above. This implies that GrubHeven will engage in processing and converting the fruits into flour that can later be added to drinks, baked foods, and others. However, other factors such as market study determine the demand and supply of products to ensure maximum sales and the most performing market segments. Since this is a new project, GrubHeven firm should also consider marketing the product through social media and modern technology to make the projected sales and realize the projected sales.

Evaluation 工作分配管理代写

The project can be evaluated using the SWOT analysis to determine the project's strengths, weaknesses, opportunities, and threats. Another tool used is the PESTEL to study the external environment and determine whether it will favor GrubHeven business activities. After the study, GrubHeven can consider introducing a product sample in the market and study before undertaking the project. The sample will experiment with the market and determine whether, on undertaking the project, the firm will make the desired profits.

Recommendation and conclusion

The recommendation to the GrubHeven firm is that they should have good market research that will study the project and determine whether the project is economically feasible. The firm should further invest in marketing and branding the project to increase awareness of the fruits flour that can be added to the drinks and the baked food, among other products.

The report has appraised the two projects of GrubHeven, and the most suitable project is the processing and conversion of the fruits into flour that can later be added to drinks and baked goods. This project is the most suitable from the Present Net Value, Profitability Index, and the Internal Rate of Return appraisal techniques.

When the project is undertaken, it can generate the desired profits in the future. This is, however, a new product in the market, and it will undergo the four stages: introduction, growth, maturity, saturation, and decline. The marketing criteria of GrubHeven will determine the annual sales and annual profit of the project.

References 工作分配管理代写

CFI. (2022). Net Present Value (N.P.V.). Corporate Finance Institute. Retrieved 28 May 2022, from https://corporatefinanceinstitute.com/resources/knowledge/valuation/net-present-value-npv/https://corporatefinanceinstitute.com/resources/knowledge/valuation/net-present-value-npv/.

Javed,:. (2021). Net present value (N.P.V) method - explanation, example, assumptions, advantages, disadvantages | Accounting For Management. Accounting For Management. Retrieved 28 May 2022, from https://www.accountingformanagement.org/net-present-value-method/.

Boundless Finance. (2022). Course Hero. Coursehero.com. Retrieved 28 May 2022, from https://www.coursehero.com/study-guides/boundless-finance/net-present-value/.

CFI. (2021). A.R.R.. - Accounting Rate of Return. Corporate Finance Institute. Retrieved 28 May 2022, from https://corporatefinanceinstitute.com/resources/knowledge/accounting/arr-accounting-rate-of-return/.

Bragg, S., & Bragg, S. (2022). Accounting rate of return definition — AccountingTools. AccountingTools. Retrieved 28 May 2022, from https://www.accountingtools.com/articles/what-is-the-accounting-rate-of-return.html.

Henricks, M. (2020). Understanding Accounting Rate of Return (A.R.R.) - SmartAsset. SmartAsset. Retrieved 28 May 2022, from 工作分配管理代写 https://smartasset.com/financial-advisor/accounting-rate-of-return.

GOCARDLESS. (2022). Accounting Rate of Return (A.R.R.) | Definition & Formula. Gocardless.com. Retrieved 28 May 2022, from https://gocardless.com/guides/posts/calculating-accounting-rate-of-return/.

CFI. (2020). Payback Period. Corporate Finance Institute. Retrieved 28 May 2022, from https://corporatefinanceinstitute.com/resources/knowledge/modeling/payback-period/.

Gocardless. (2020). How to calculate the payback period | Definition & Formula. Gocardless.com. Retrieved 28 May 2022, from https://gocardless.com/guides/posts/how-to-calculate-payback-period/.

Javed, R. (2020). Payback method - formula, example, explanation, advantages, disadvantages | Accounting For Management. Accounting For Management. Retrieved 28 May 2022, from https://www.accountingformanagement.org/payback-method/.

CFI. (2020). Sources of Funding. Corporate Finance Institute. Retrieved 28 May 2022, from https://corporatefinanceinstitute.com/resources/knowledge/finance/sources-of-funding/#:~:text=Summary,public%20(issuing%20debt%20securities).

C.F.A. (2022). Sources of Capital. C.F.A. Institute. Retrieved 28 May 2022, from https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/sources-capital.

Carbajo, M. (2020). Top Sources of Capital for Business Owners. The Balance Small Business. Retrieved 28 May 2022, from https://www.thebalancesmb.com/discover-the-top-sources-of-capital-for-business-owners-4049539.

Borad, S. (2022). Investment Appraisal Techniques. eFinanceManagement. Retrieved 28 May 2022, from 工作分配管理代写 https://efinancemanagement.com/investment-decisions/investment-appraisal-techniques.

Wilson, S. (2020). What Are the Types of Project Appraisal Methodologies?. Small Business - Chron.com. Retrieved 28 May 2022, from https://smallbusiness.chron.com/types-project-appraisal-methodologies-14716.html.

发表回复

要发表评论,您必须先登录。