corporate finance

企业融资quiz代考 You are planning to offffer cafe food at your bar. This will entail an increase in inventory of $5000, an increase in accounts

ABC Inc. currently sell its lawnmowers at $120 each. The COGS for every lawnmower is $50, and ABC expects to sell 10,000 units over the next year. ABC plans to lower prices to $100 per lawnmower. If the price reduction happens, ABC expects the number of units sold to increase by 20%. Furthermore, with greater scale of economies, the COGS per lawnmower will fall by 10%. What is the incremental impact of the price reduction on EBIT? Choose the closest answer.

Without price reduction:

EBIT = 10000 × ($120 − $50) = $700000

With price reduction:

EBIT = 10000 × (1 + 20%) × ($100 − $50 × 0.9) = $660000 企业融资quiz代考

Incremental impact on EBIT:

∆ = $660000 − $700000 = $40000

- Which of the following cash flflows are relevant in a capital budgeting exercise?

Tax savings arising from depreciation expenses of project

- You are planning to offffer cafe food at your bar. This will entail an increase in inventory of $5000, an increase in accounts payable of $1500, and an increase in property, plant, and equipment of $50000 (due to the installation of a kitchen). All else being the same, the change in net working capital from this project is closest to:

The change in net working capital is:

$5000 − $1500 = $3500

- This question pertains to the Law of One Price. The stock of ABC Inc. is listed on both the Australian stock exchange and the U.S. stock exchange. On the Australian stock exchange, each ABC share has a price of AUD 10.20. On the U.S. stock exchange, each ABC share has aprice of USD 7.50. Absent fifinancial frictions, what is the no-arbitrage AUD/USD exchange rate? Express your answer in AUD per one USD.

The no-arbitrage exchange rate is:

- Which of the follow statements is false? The correlation between prices of two assets allows us to gauge the strength of their relation. 企业融资quiz代考

- Which of the follow statements is false? When a fifirm faces fifinancial distress, shareholders can gain by making suffiffifficiently risky investments, even if they have negative NPV.

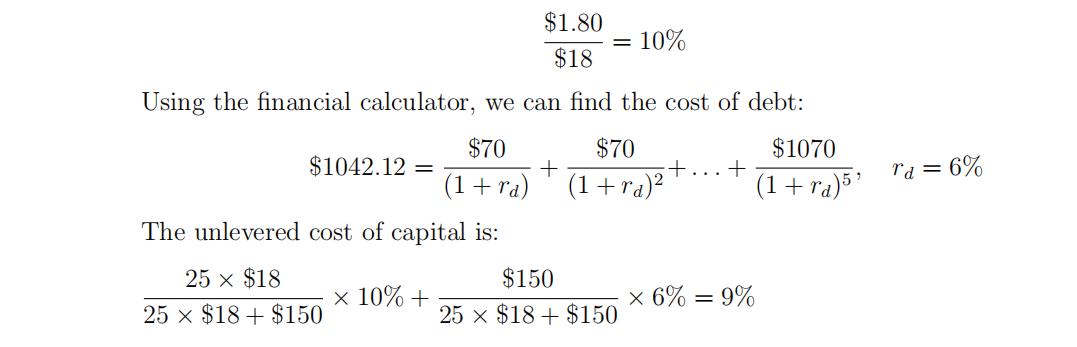

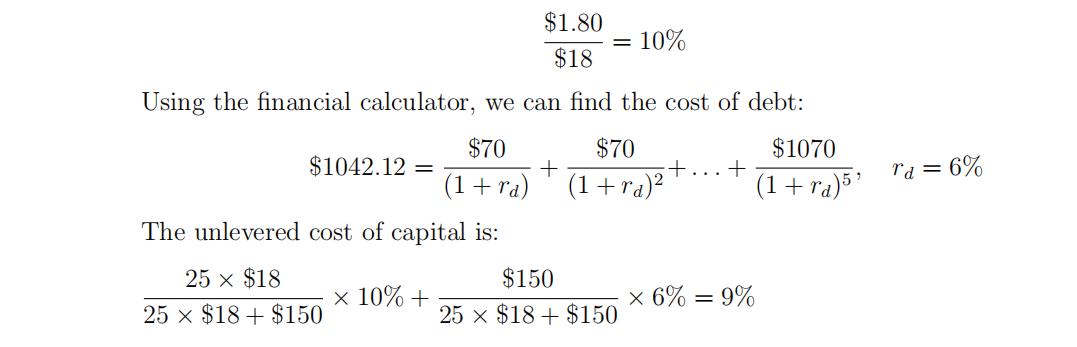

- Use the following information to answer the next two questions. ABC Inc. has 25 million shares outstanding trading at $18 per share. Going forward, the market expects ABC to pay an annual dividend of $1.80 per share. ABC also has $150 million in outstanding debt in the form of bonds. These annual bonds have a face value of $1000, a coupon rate of 7%, have 5 years to maturity, and are trading at $1042.12. What is the unlevered cost of capital of ABC? Suppose XYZ operates the same business as ABC. However the D/E ratio of XYZ is 3 times that of ABC. XYZ and ABC have the same costs of debt. What is the cost of equity of XYZ?

The cost of equity is:

XYZ has a cost of equity:

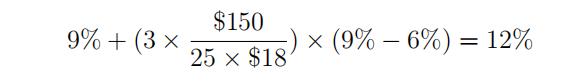

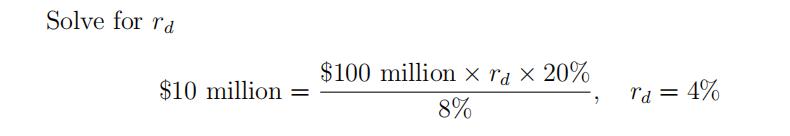

- ABC has 20 million shares outstanding, trading at $20 per share. ABC currently has no debt, but plans to borrow $100 million on a permanent basis. It would use the borrowed funds to repurchase shares. Upon the announcement of this plan, ABC’s share price rose to $20.50. Assume that the discount rate on interest tax shields is 8% and the marginal corporate tax rate = 20%. What is ABC’s cost of debt?

The value of interest tax shields is: 企业融资quiz代考

20 million × ($20.50 − $20) = $10 million

- ABC Inc. has a $10 million loan due at the end of the year. Under its current business strategy, its assets will have a market value of $8 million when the loan is due. ABC may choose an alternative business strategy without any additional investment. The alternative strategy has only a 40% chance of success. If the alternative strategy succeeds, the market value of ABC’s assets will be $20 million. If the alternative strategy fails, the assets would be worth only $5 million. What is the expected loss to ABC’s debt holders if it switches to the alternative strategy?

The expected payoffff to debt holders under the alternative strategy is: 企业融资quiz代考

0.4 × $10 million + 0.6 × $5 million = $7 million

Expected loss to debt holders due to the switch:

$7 million − $8 million = −$1 million 企业融资quiz代考

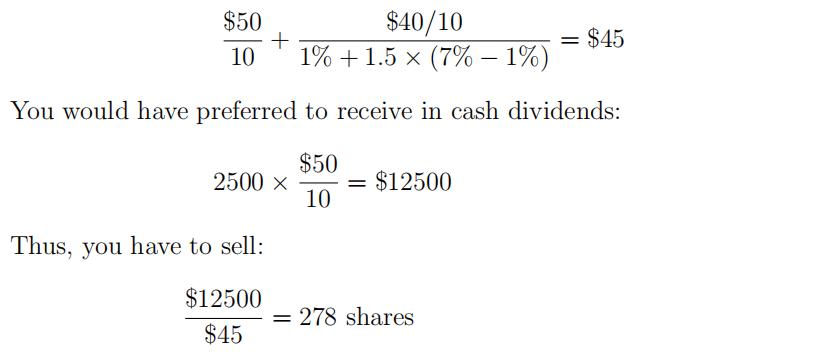

- ABC Inc. currently has $50 million in excess cash and no debt. In subsequent years, the fifirm expects to generate additional free cash flflows of $40 million per year and pay them out as regular dividends. ABC has an asset beta of 1.5. The risk free rate is 1% and the expected market return is 7%. There are 10 million shares outstanding. Suppose that you own 2500 shares of ABC stock, and that ABC uses the entire $50 million to repurchase shares. However, you prefer that ABC used the excess cash to pay a special dividend instead. How many shares do you have to sell?

In a perfect capital market, a share repurchase does not change the stock price. The stock price is:

更多代写:cs代写 经济代考 会计代写 计算机科学代写 如何写conclusion

发表回复

要发表评论,您必须先登录。