ECON3006/4437/8037: Financial Economics

金融经济学代写 you can take ANY probability model, it just should fit the data. At some point a nonlinear equation may come up; use (for instance):

General Information: 金融经济学代写

• 100 % = 27 points.

• Maximal 3 students can submit one solution of Assignment 2. All students within the group receive the same grade. Only 1 student of the group shall submit the solution WITH uni-ids of students within

the group. The other student(s) submits his/her uni id and the uni id of students within the group.

• Name the uploaded file in the form of “uni id-A2”.

• Only working within each group is allowed. Please use wattle to build groups.

• Your submitted solutions should not exceed more than 3 pages! Please keep a copy of your solutions.

• Due on Friday 15/10/2021 by 7:55 PM. Late assignment will not be accepted.

Solve the following seven problems. 金融经济学代写

- (5 points) Compute the formula in the box on slide 5 of Week 9.

Hints: - The constrained problem on slide 5 is the base.

- Substituting the constraints into the objective, and setting the derivative with respect to z equal to zero.

- We then obtain FOC for an optimal consumption and portfolio choice.

(4 points) Rewrite the two budget sets from Week 9 on slide 3 so that consumption at time t = 0 and time t = 1 would be possible. Explain both modifications with 4 sentences.

(2 points) Explain which properties of the conditional expectation are used to derive on slide 8 of Week 9 the equality

Hint: Use tool kit from Week 8.

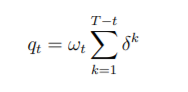

- (3 points) What are the properties of the risky asset’s price qt (based on the stochastic Euler equation) if dividends are constants (non stochastic), i.e. on the certainty line CL at each time. Explain your answer

with 2 sentences. (6 Points)

(a) (3 Points) Compute Australia average growth rate g between 2000- 2020 and the standard deviation σ(g).

(b) v Find a probability model of g with 3 states (bad, normal, good; i.e. S = {b, n, g} that matches the first two moments, E[g], σ(g).

If you do not solve part (a), g(n) = 2%, g(g) = 5% and g(b) can be chosen.

Hints:

(a) You have to find the data online. Deliver a screenshot, if you use the computer.

(b) you can take ANY probability model, it just should fit the data. At some point a nonlinear equation may come up; use (for instance): wolframalpha.com

- (4 points) Compute the risk free rate and the risk premium, based on CCAPM, for a risk neutral representative agent. For the same economy derive the stochastic Euler equation.

Before the derivation state and specify all the involved primitives of the model you consider.

- (3 points) Screen the web and find 3 different explanations (each explanation around 2-3 sentences) of the REH. State for each explanation the source (such as webpage, research paper, book, lecture notes, etc.)

更多代写:

更多代写:

发表回复

要发表评论,您必须先登录。