corporate finance online quiz

企业金融考试代写 MM Proposition II (with no taxes) states that:I) the expected return on equity is positively related to leverage;II) the required

Question 1 企业金融考试代写

In order to accumulate $100,000 in 10 years, how much single amount do you have to deposit now if the saving account can generate 3.6% p.a. compounded quarterly?

A. 69880.07

B. 70210.56

C. 91429.92

D. 24300.20

E. None of the above

Answer A The effective quarterly rate = 3.6%/4 = 0.9% PV = 100000/(1+0.9%)^40=69880.07

Question 2

You are evaluating two mutually exclusive projects (Project A and Project B) and find the profitability index (PI) of the two projects are 1.23 and 1.05 respectively. Which of the following comments is CORRECT?

A. You should accept both projects.

B. Project A will generate higher NPV than B.

C. Project B will generate higher NPV than A.

D. It is likely that the NPV of Project B is negative.

E. It is uncertain which project tends to maximise shareholder wealth.

Answer: E

PI is a relative measure which doesn’t reflect the absolute value added.

Question 3 企业金融考试代写

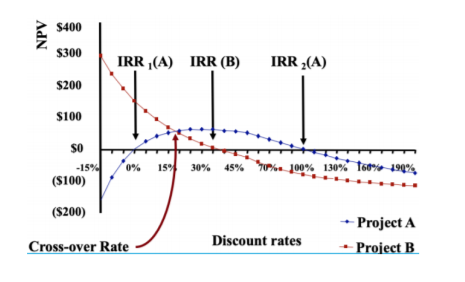

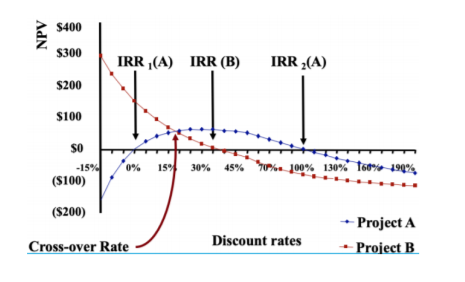

You are evaluating two mutually exclusive projects (Project A and Project B) and plot the NPV profile of the two projects to aid your analysis. Assume the cross-over rate is 15.5% and IRR (B) is 35%. Which of the following choices can help to maximise the value of your firm?

A. You should accept both projects.

B. Project A

C. Project B

D. Both projects should be abandoned.

E. It is uncertain which project tends to maximise shareholder wealth.

Answer: C the cost of capital is greater than 0% and below 15.5% where curve B is above curve A.

Question 4

In project evaluation, an increase in debt interest rate will

A. increase free cash flow

B. decrease free cash flow

C. decrease the cost of capital

D. increase the cost of capital

E. None of the above

Answer: D Interest is paid out of free cash flow so the increase in interest rate will not influence free cash flow. All else remain unchanged, increasing interest rate will cause WACC to increase.

Question 5 企业金融考试代写

The annual free cash flow (FCF) of a project is equal to (10000-cost)0.7 and the cost of capital is 10% p.a. If the initial investment is 35,000 and the project has an infinite life, the break-even cost is closet to:

A. 10,000

B. 7,000

C. 5,000

D. 0

E. None of the above

Answer: C

(10000-cost)0.7/0.1 = 35000, cost = 5000

Question 6

Assuming other factors remain unchanged, which of the following changes will decrease free cash flow?

A. an increase in net working capital

B. a decrease in net working capital

C. a decrease in financing costs

D. an increase in financing costs

E. None of the above

Answer: A, financing costs are not incremental cash flows.

Question 7

NBN Ltd is an all equity financed company and decides to buy back some shares by issuing debts to change its exiting capital structure. If MM (with tax) theory holds, which of the following value will most likely to decrease after the capital restructure?

A. Weighted average cost of capital (WACC)

B. Share price

C. The wealth of shareholders

D. Cost of equity

E. None of the above

Answer: A

The tax shield benefits will increase firm value and share price. Cost of equity will increase due to higher leverage (so as to higher systematic risk). Unlevered cash flow remains unchanged but firm value increases. Thus WACC should decline.

Question 8 企业金融考试代写

NDC announced to buy back shares using funds raised from the bond market. The total benefits of borrowing are estimated to be $3 million and the company has 1 million shares outstanding. The share price of NDC increased from $20 to $22 on the announcement. Assuming the tax rate is 30%, the expected total financial distress cost is closet to:

A. $2 million

B. $0.6 million

C. $0.9 million

D. $1 million

E. None of the above

Answer: D

Share price will increase by the average tax saving and decrease by the expected financial distress cost. P(post-annoucement) = P(pre-annoucement) + PV(tax shield)-PV( distress) 22 = 20 +3 – PV(distress), PV (distress) = 1m

Question 9

NET reported the following levered cash flows (free cash flow to equity) of a project. Time 0 Time 1 Time 2 -30,000 40,000 60,000 The required rate of return of equity is 10%, the cost of debt is 5%, the D/E ratio is 1 and the tax rate is 30%. The NPV of the project is:

A. $46,859

B. $60,000

C. $32,231

D. $55,950

E. $90,000

Answer: D

(the cash flows are free cash flow to equity, so the discount rate should be the cost of equity) =40000/1.1+60000/1.1^2-30000 = 55950

Question 10 企业金融考试代写

The market portfolio in the capital asset pricing model (CAPM)

A. only contains shares listed on the stock exchange.

B. is constructed differently for investors with different levels of risk aversion.

C. is tradable in reality.

D. is usually represented by a bond market index in practice.

E. is assumed to be held by all investors.

Answer: E

(Market portfolio is the only risky asset held by all the investors so it contains all the assets available for investment, regardless of the marketability in the real world. It is usually represented by a stock market index)

Question 11

In the following three-factor model: E(R)=rf+beta1F1+beta2F2+beta3F3 Assume risk free return is 3%, beta1 = 1, beta2 = 1.6 and beta3= 1.5. The risk premium of the three factors (F1 to F3) are 4%, 2% and 3.5% respectively. The expected return according to the model is

A. 15.45%

B. 11.35%

C. 11.95%

D. 14.22%

E. 12.35%

Answer: A =0.03+10.04+1.60.02+1.50.035 = 15.45%

Question 12 企业金融考试代写

Titman Industries has a levered cost of equity of 14.2%. Titman’s borrowing interest rate is 7% per annum and corporate tax rate is 30%. If Tasgrid expects to maintain a debt to equity ratio of 2, then Titman’s unlevered cost of capital is closest to:

A. 10% p.a.

B. 15.2% p.a.

C. 6.8% p.a.

D. 16.6% p.a.

E. None of the above

Answer: A

Re=ru+(ru-rd)D/E(1-t) 14.2%=x+(x-0.07)20.7,x=10%

Question 13

The pecking order theory of capital structure predicts that

A. Profitable firms should borrow less than unprofitable ones

B. Safe firms should borrow more than risky ones

C. Rapid growing firms should borrow more than mature firms

D. Increasing leverage increases firm value

E. Increasing leverage will decrease free cash flow

Answer: A

Question 14

You just inherited a trust that will pay you $100,000 per year in perpetuity. However, the first payment will not occur for exactly four more years. Assuming an 8% annual interest rate, what is the value of this trust?

A. $918,787

B. $992,787

C. $1,000,000

D. $1,250,000

E. $1,100,000

Answer: A=(100000/0.08)*(1.08^-4)=918787

Question 15 企业金融考试代写

A company has $50,000 of debt outstanding has 10,000 shares outstanding and a stock price of $20. If the unlevered beta is 0.80, debt is risk-free (beta of zero) and the marginal tax rate is 20%, what is the company's levered beta?

A. 0.75

B. 0.80

C. 0.85

D. 0.90

E. 0.96

Answer E

Levered beta = unlevered beta+(unlevered beta-debt beta)D/E(1-t)=0.8+(0.8-0)(50000/200000)(1-0.2)=0.96

Question 16

For project Z, year 5 inventories increase by $6,000, accounts receivable increases by $4,000, and accounts payable increases by $3,000. Calculate the increase or decrease in net working capital for year 5.

A. increases by $5,000

B. decreases by $1,000

C. increases by $7,000

D. decreases by $7,000

E. Increases by $13,000

Answer C

Changes in current asset = 6000+4000 = 10000, changes in current liability = 3000, changes in NWC = 10000-3000= 7000 increase

Question 17 企业金融考试代写

Agency problems can be alleviated by:

A. Mandating information disclosure.

B. Compensating managers in such a way that acting in the best interest of shareholders is also in the

best interest of managers.

C. Asking managers to take on more risk than they are comfortable taking.

D. A and B.

E. A, B and C.

Answer: D

Question 18

The trade-off theory of capital structure predicts that:

A. Unprofitable firms should borrow more than profitable ones

B. Safe firms should borrow more than risky ones

C. Rapidly growing firms should borrow more than mature firms

D. Increasing leverage increases firm value

E. Increasing leverage will decrease free cash flow

Answer: B

Question 19

MM Proposition II (with no taxes) states that:I) the expected return on equity is positively related to leverage;II) the required return on equity is a linear function of the firm's debt to equity ratio;III) the risk to equity increases with leverage

A. I only

B. II only

C. III only

D. I, II, and III

E. II and III only

D, check the formula of levered cost of equity

Question 20 企业金融考试代写

Suppose that Rose Industries is considering the acquisition of another firm in its industry for $100 million. The acquisition is expected to increase Rose's unlevered free cash flow by $5 million the first year, and this contribution is expected to grow at a rate of 3% every year thereafter. Rose has an unlevered cost of equity of 8%p.a., a marginal tax rate of 40%, its cost of debt rD is 6% p.a., and its levered cost of equity, rS , is 10% p.a. Given that Rose issues new perpetual debt of $100 million initially to fund the acquisition, the total net present value of this acquisition using the APV method is closest to:

A. $0 million

B. $40 million

C. $48 million

D. $15 million

E. $12 million

Answer: B

Base Value is V= $100 million (Note we use the unlevered cost of capital, 8%, to discount unlevered cashflows) Interest tax shield in first year = $100(.06)(.40) = $2.4 million PV(tax shield) in perpetuity= 2.4m/(.06)=40million APV= Base Case NPV + PV(interest tax shield) = -$100m+ $100 million + $40 million = $40 million

[Note: we use cost of debt to value the interest tax shields where level of debt is known given the tax deduction for interest expense is considered no riskier than the debt to which it relates]

更多代写: HomeWork cs作业 金融代考 postgreSQL代写 IT assignment代写 统计代写 马里兰综合健康大学代写

更多代写: HomeWork cs作业 金融代考 postgreSQL代写 IT assignment代写 统计代写 马里兰综合健康大学代写

发表回复

要发表评论,您必须先登录。